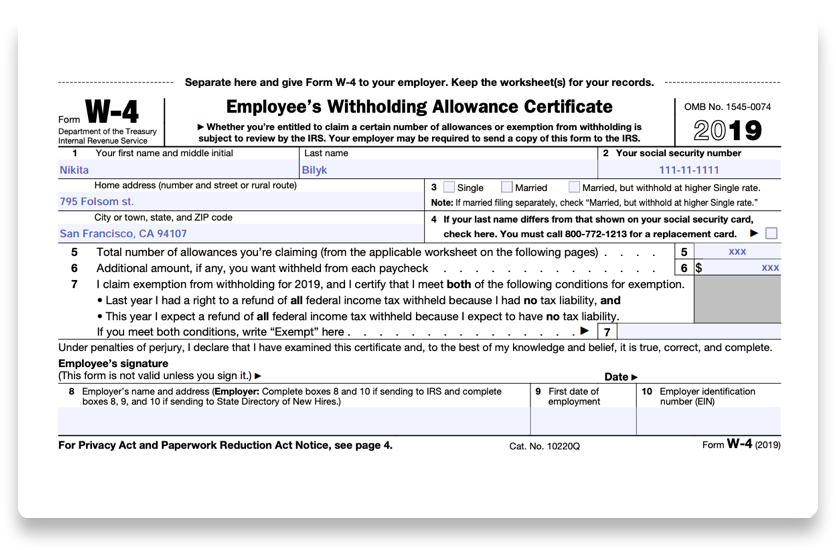

2019 W 4 Printable 2019 W 4 W4 Form 2019

Line 16 on your 2019 form 1040 or 1040 sr is zero or less than the sum of lines 18a 18b and 18c or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status.

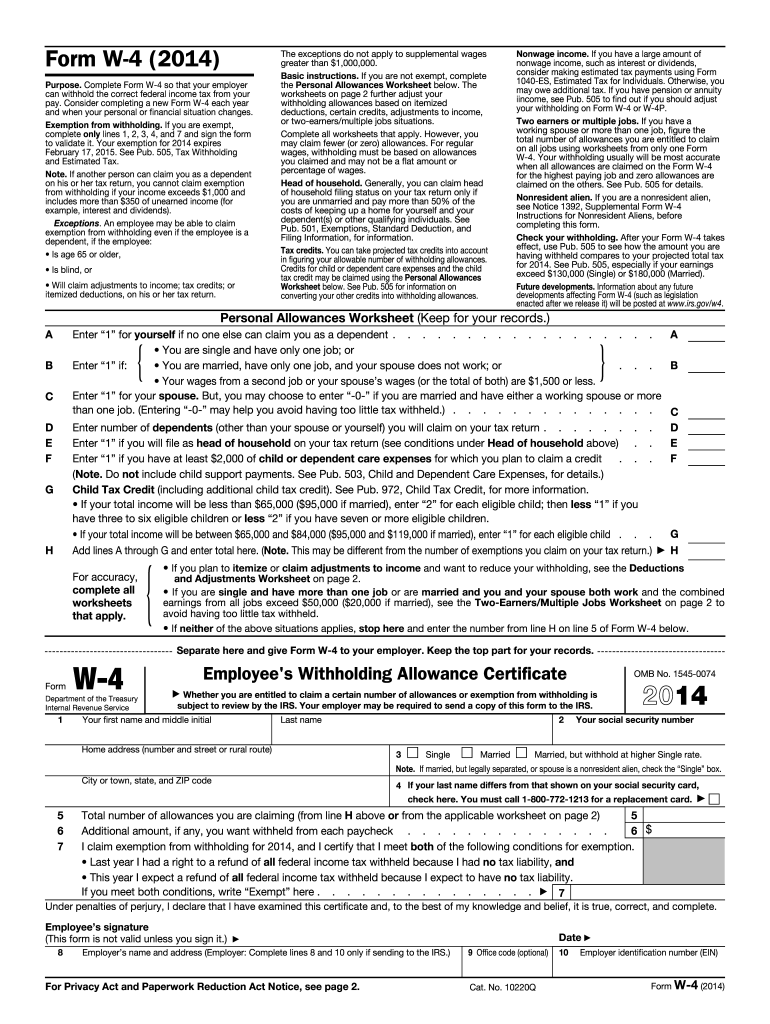

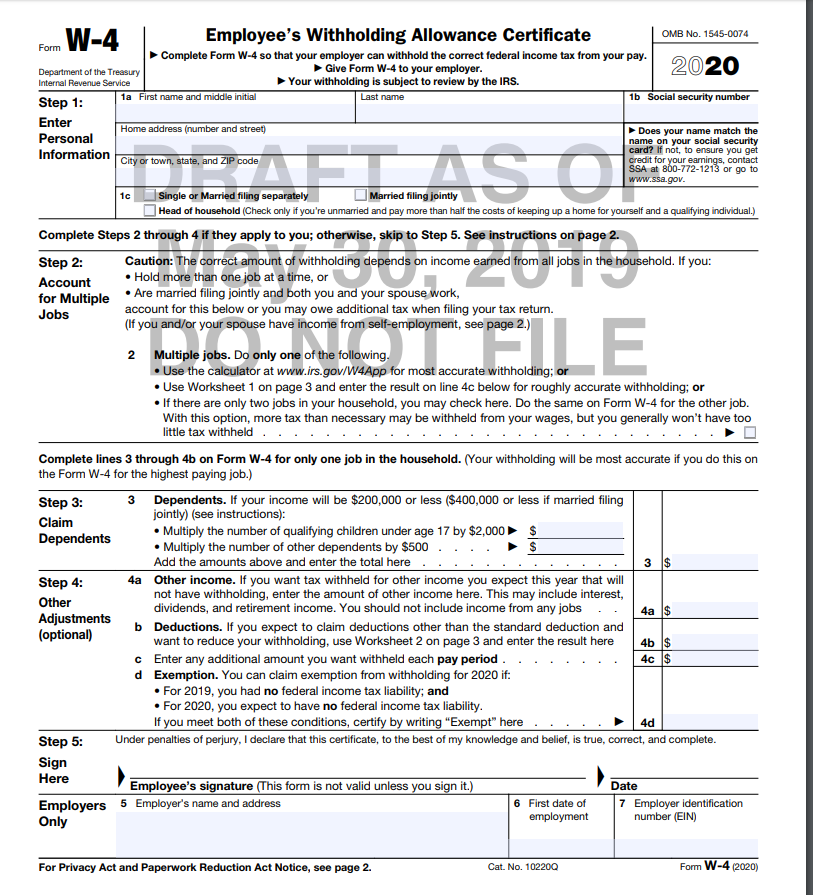

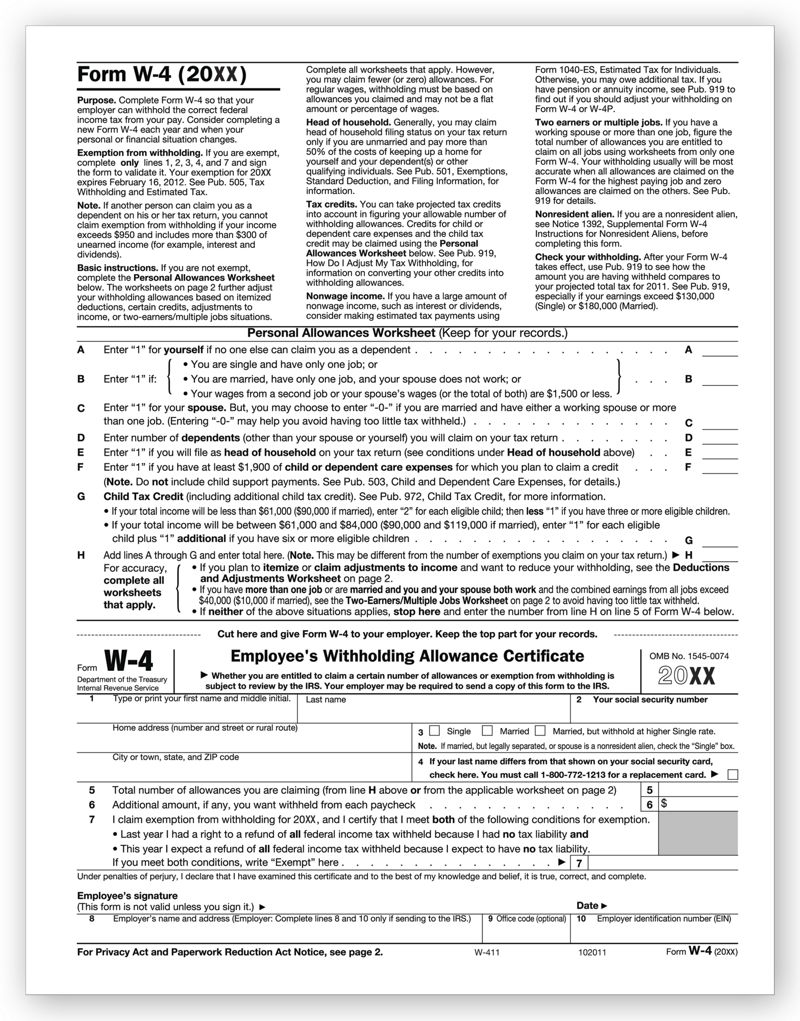

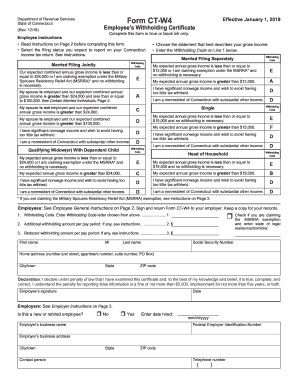

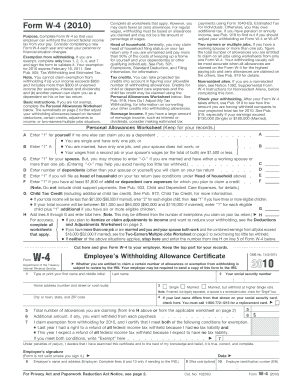

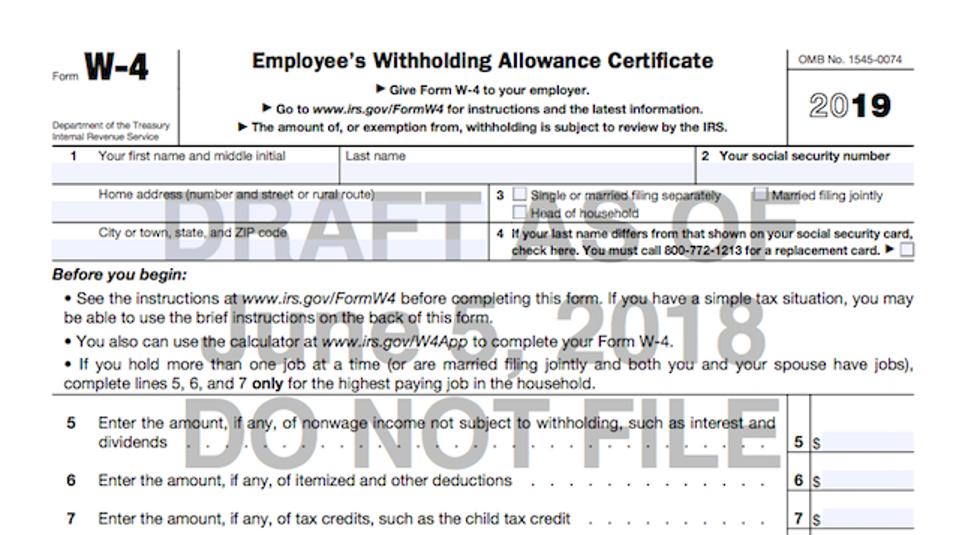

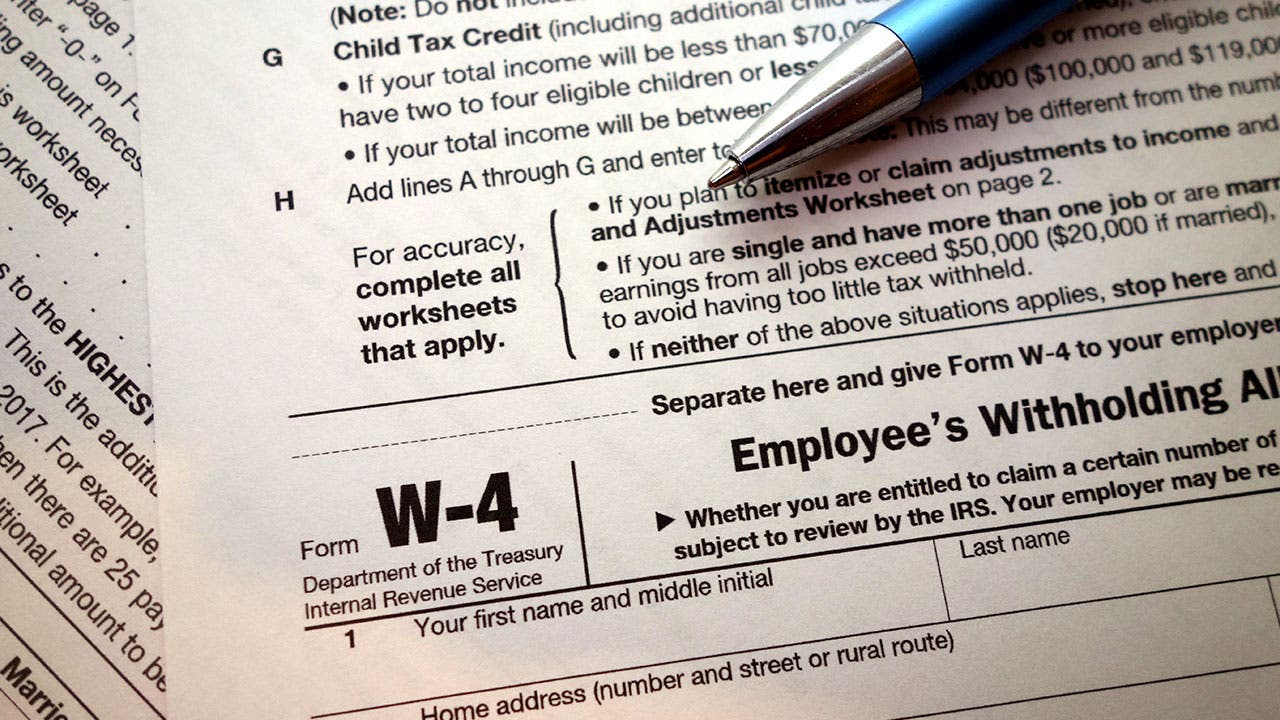

2019 w 4 printable 2019 w 4 w4 form 2019. Consider completing a new form w 4 each year and when your personal or financial situation changes. If the number of your claimed must file a new form il w 4 within 10 days. Form w 4 2020 employees withholding certificate. After your form w 4 takes effect you can also use this calculator to see how the amount of tax youre having withheld compares to your projected total tax for 2019.

Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. Reap the benefits of a electronic solution to create edit and sign contracts in pdf or word format on the web. Turn them into templates for multiple use add fillable fields to gather recipients. Form w 4 sp employees withholding certificate spanish version 2019 12132019 form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p.

Work from any gadget and share docs by email or fax. If you use the calculator you dont need to complete any of the worksheets for form w 4. Si tiene que ajustar su retencion en el formulario w 4sp o el formulario w 4p en ingles. You may claim exemption from withholding for 2019 if both of the following apply.

You may file a new form il w 4 any time your withholding allowances increase. Withholding certificate for pension or annuity payments 2019 02032020 form w 4p. 2019 w 4 form printable. Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay.

Complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Withholding certificate for pension or annuity payments 2020. You must submit form il w 4 when illinois income tax is required to be withheld from compensation that you receive as an employee. Si es extranjero no residente vea el aviso 1392 supplemental form w 4 instructions for nonresident aliens instrucciones complementarias para el formulario w 4 para extranjeros no residentes.

Note that if you have too much tax withheld you will receive a refund when you. Existing employees that change the number of their wisconsin withholding exemptions must provide form wt 4 to their employer.