Certificate Vs Ira

What is an ira cd certificate of deposit.

Certificate vs ira. An important distinction to make between a certificate of deposit cd. The ira cd that evan asked about is simply a cd thats owned within either a traditional or a roth ira. Both traditional and roth ira accounts offer tax. Rebecca lake dec 10 2019.

An individual retirement account ira can be considered an individual savings and investment account that has tax benefits. The money you deposit in and earn on your. A cd or certificate of deposit is a financial product. A cd is a bank product that pays higher interest than a regular savings account because you give up use of your money for a set period of time.

The tax benefits you receive depend on whether your invest in a traditional ira certificate or a roth ira certificate. An individual retirement account ira is a special type of account that has specific tax benefits. An ira share account is a credit union retirement account that operates similarly to an ira retirement savings account in a bank. An individual retirement account or a certificate of deposit allows you to earn interest today on money youll use in the future.

Once the cd matures you can take the money out or roll it over for a new term. Individual retirement account certificates offer a few key benefits for conservative investors. Ira certificates combine the safe fixed interest return of a regular cd with the tax benefits of an ira. But if youre planning to invest your ira contributions in a certificate of deposit you might want to take a step backfirst consider the pros and the cons of putting large portions of your.

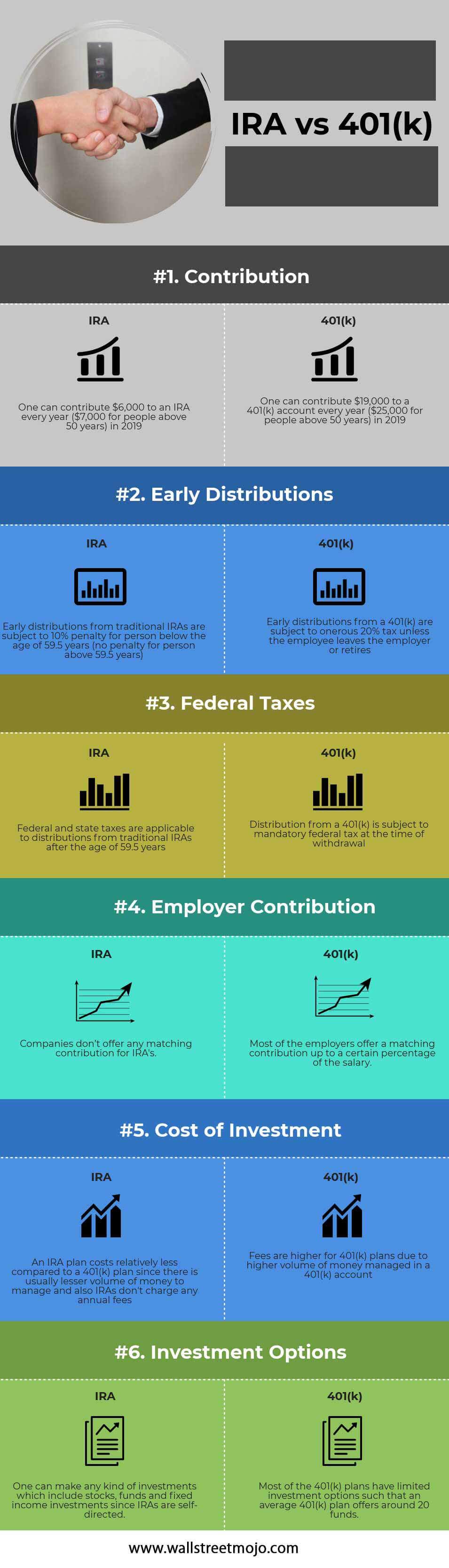

The primary difference between traditional and roth iras is in the tax treatment of your deposits to and withdrawals from these retirement plans. When you invest in a certificate of deposit the money earns interest over a set period time which may be a few months or a few years depending on the cd. Ira cd vs traditional or roth ira. Congress as part of the 1974 employee retirement income security act to provide taxpayers who were not covered by a qualified retirement plan with a means.

Iras were authorized by the us. Banks or other financial institutions offer customers a higher interest rate in exchange for the customer committing to keeping the funds in the account for a set period of time.

/GettyImages-1064145406-bc5438f2d0fa47b9a0a8dedce123b302.jpg)