City Business Tax Receipt

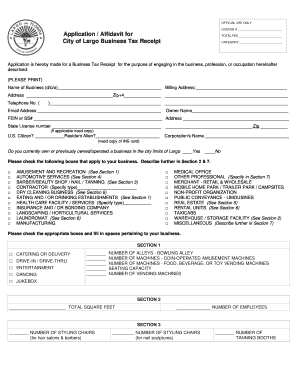

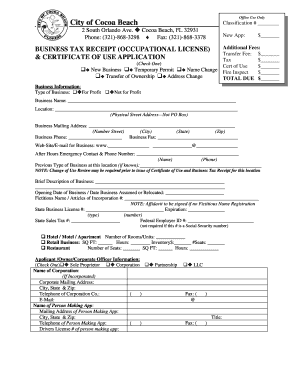

Download the application for business tax receipt for a list of instructions and documents needed.

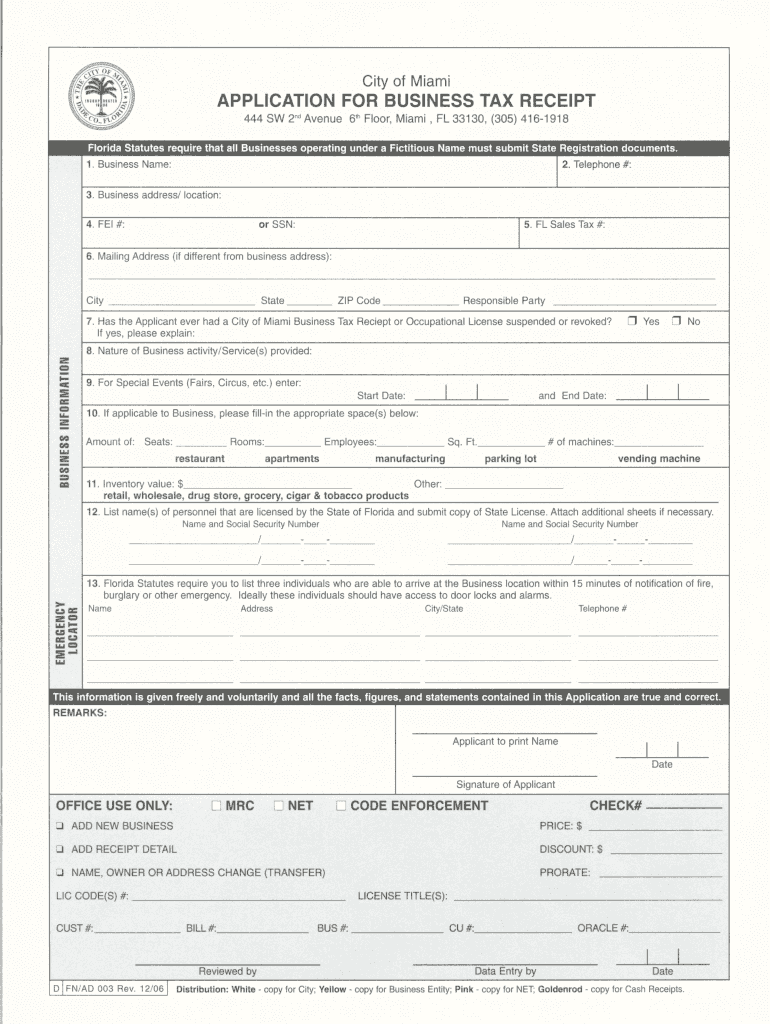

City business tax receipt. Any businesses located in another municipality in duval county are required to obtain a city business tax receipt from that municipality where the business is located in addition to paying the county tax for duval county. Any person doing business in jacksonvilleduval county must obtain a local business tax receipt. In addition every business is also required to obtain a miami dade county local business tax receipt formerly known as an occupational license. A separate business tax receipt is required for each place of business.

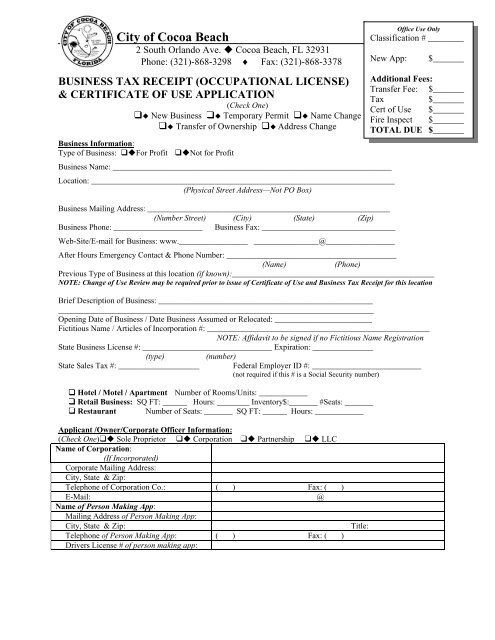

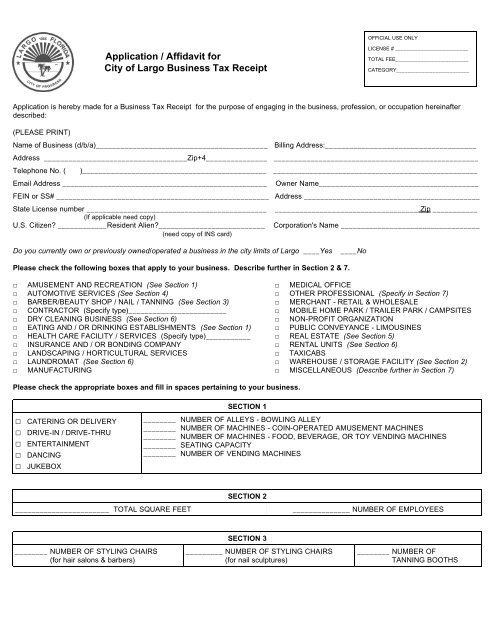

A business tax receipt is required for any business performing services or selling goods advertising goods for sale or advertising the performance of services for a fee. Business tax receipts the building division issues business tax receipts to those having a commercial andor residential business within the city limits of haines city. The orange county tax collectors office is located on the 16th floor of the suntrust center at 200 south orange avenue orlando. Prior to applying and paying for a business tax receipt it should be determined if the business meets the haines city zoning requirement for that location and if any federal andor state certification or inspections are required.

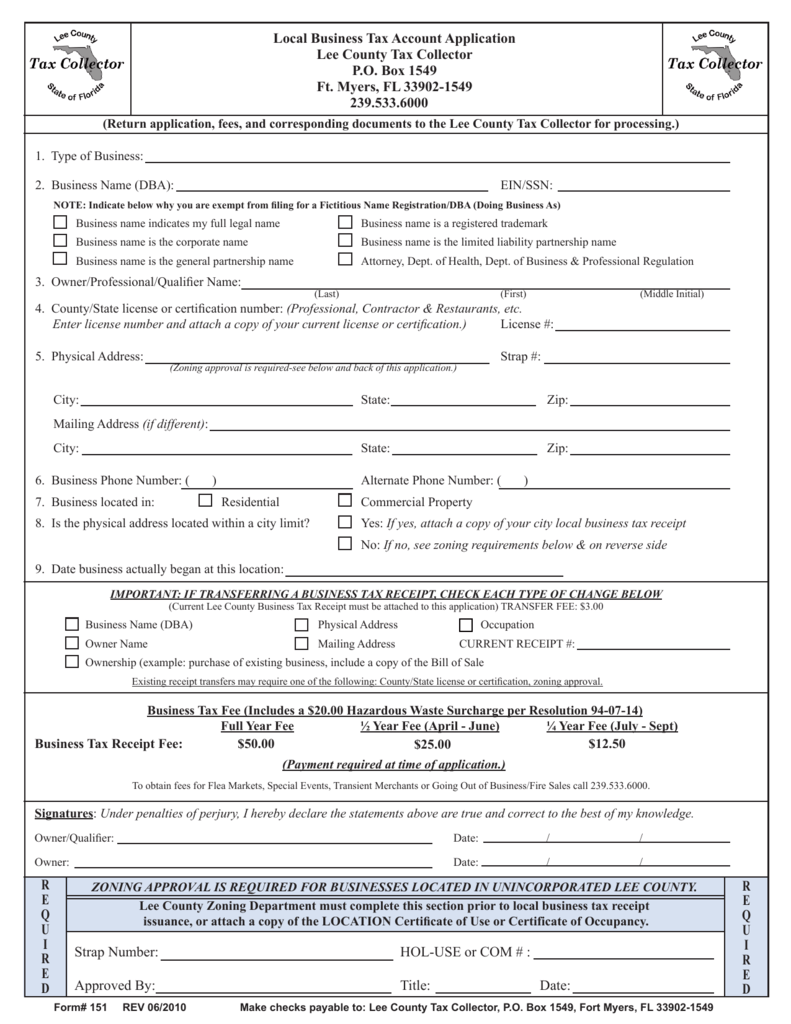

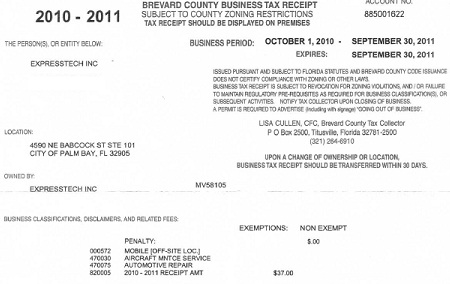

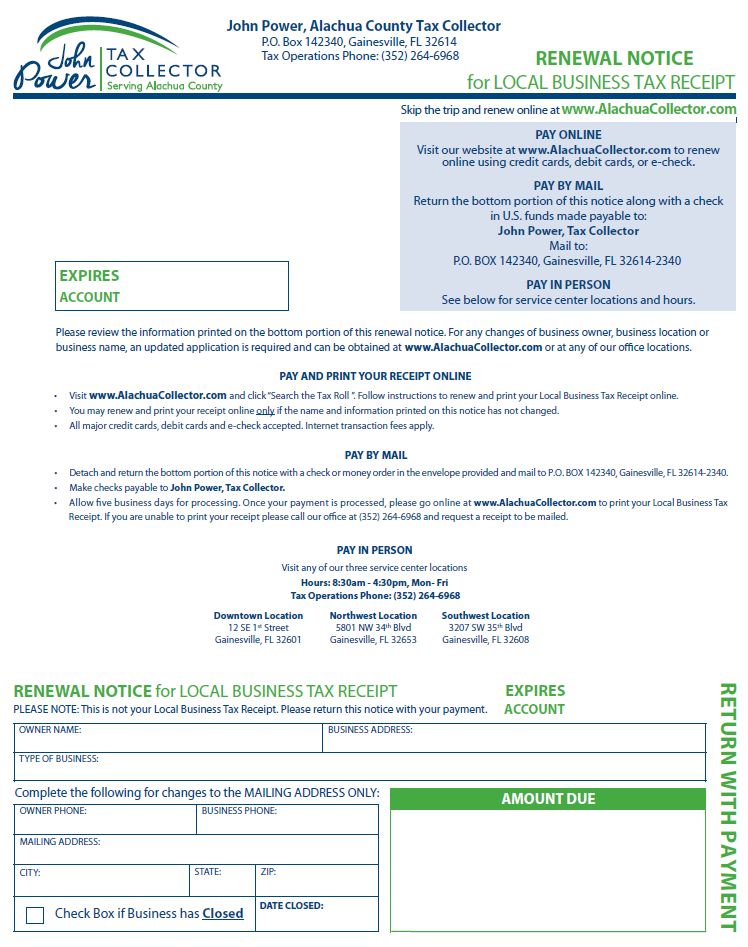

Get an orange county business tax receipt. Most businesses need a cu before they can get a btr exceptions include peddlers. Business tax receipts are payable annually july 1 through september 30. Local business tax receipts btr formerly occupational licenses are issued by the constitutional tax collectors office.

For tax years beginning on or after january 1 2015 a new corporate tax applies to corporations and banks other than federal s corporations that do business in new york city. All businesses located within the city limits of clearwater shall obtain a business tax receipt prior to the commencement of business or the practice of a profession. The new tax is being referred to as the business corporation tax. Their phone number is 4078365650.

All businesses must have both city and county business tax receipts. Local business tax receipts are the method used by a local government to grant the privilege of engaging in or managing any business profession the business tax division is part of the city of tampas neighborhood empowerment department and is responsible for the issuance and collection for all business tax receipts under the authority of chapter 24 of the city of tampa code. Unincorporated business tax ubt utility tax directory of city agencies contact nyc government city employees notify nyc citystore stay connected nyc mobile apps maps resident toolkit.