Excel Mileage Calculator Template

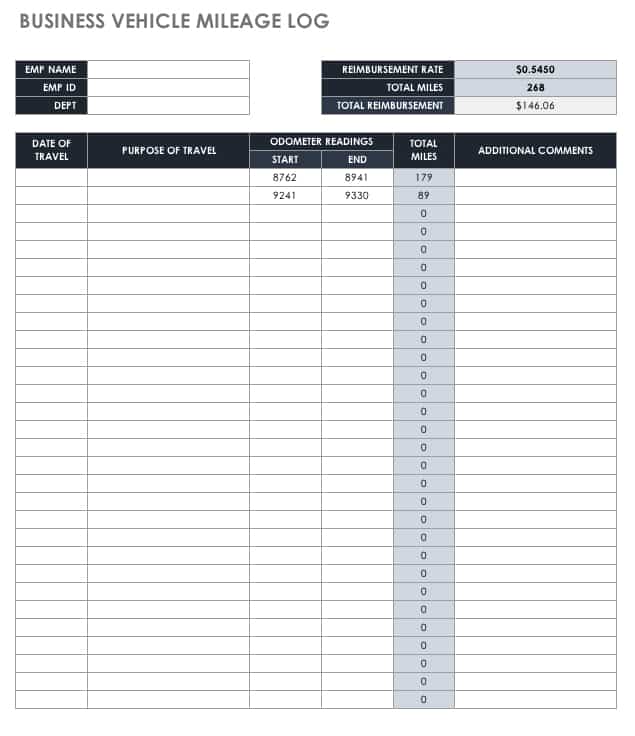

This template will calculate the value of your business trips based on this figure.

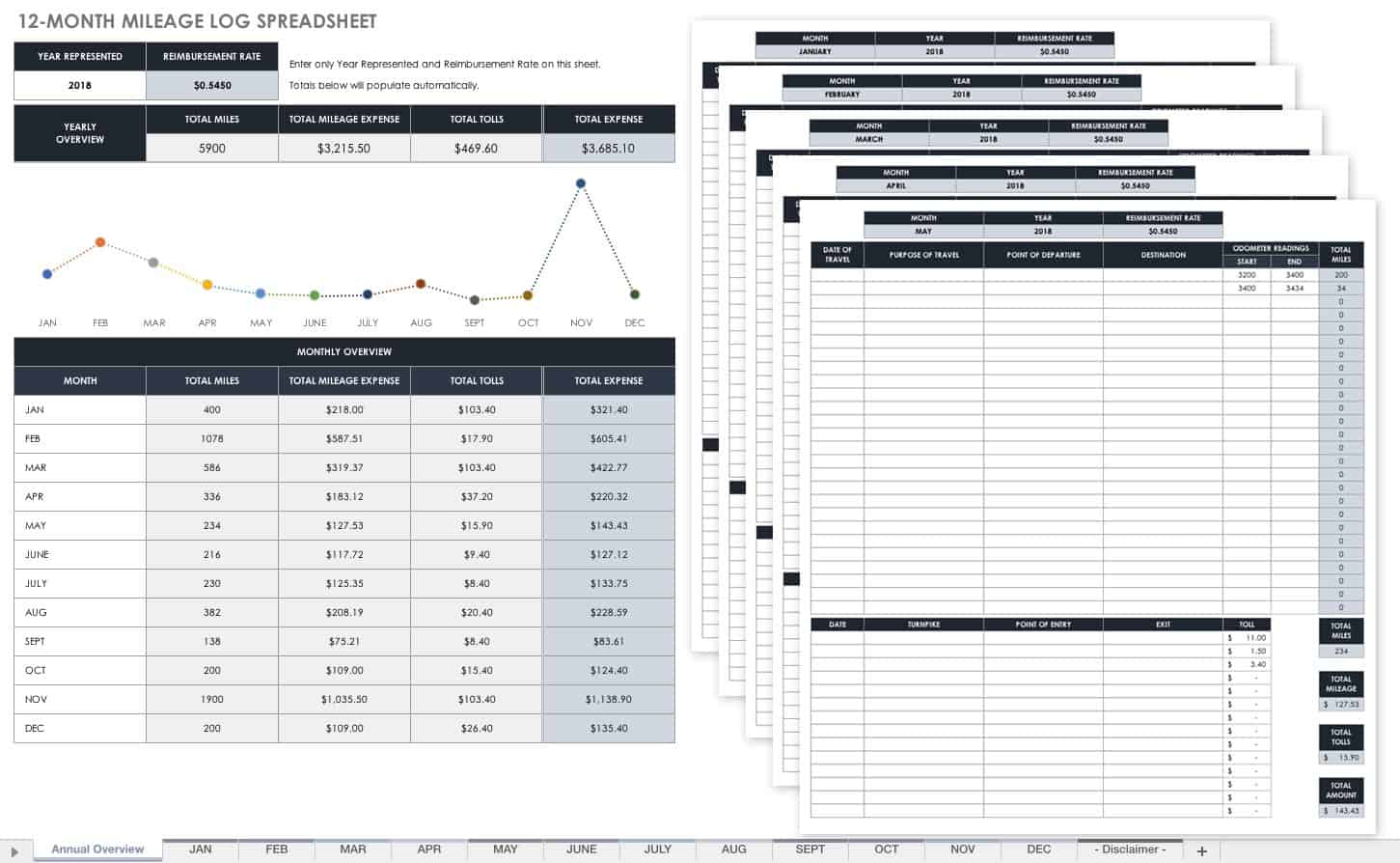

Excel mileage calculator template. How to calculate mileage log deductions. The current starting in 2018 irs standard mileage rate is 545 cents per business mile. In a simple word a mileage log template is a fitness guide of your vehicle. The use of the template is very beneficial in many ways.

Plus on the internet you get a very professional looking one. Want to know how much your next road trip will cost. If you are running a business by your own or doing a job in other company you have to record your mileage the hours you spend in drive or the hours which are expended by you in doing your extra work rather than the duty. Mileage log is a statement build in excel to know about the mileage of the business or vehicle.

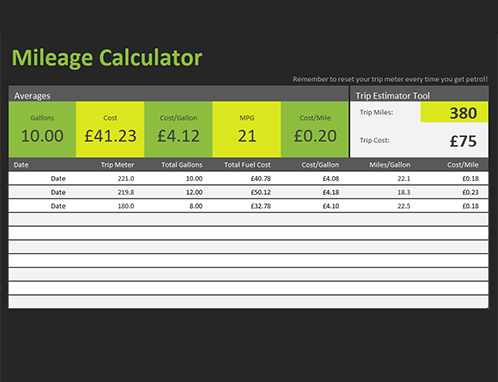

Mileage and reimbursement amounts are calculated for you to submit as an expense report. The template will also help you to calculate the amount you are owed. 10 excel mileage log templates. Type the number of miles in the yellow box and the cost will be calculated for you.

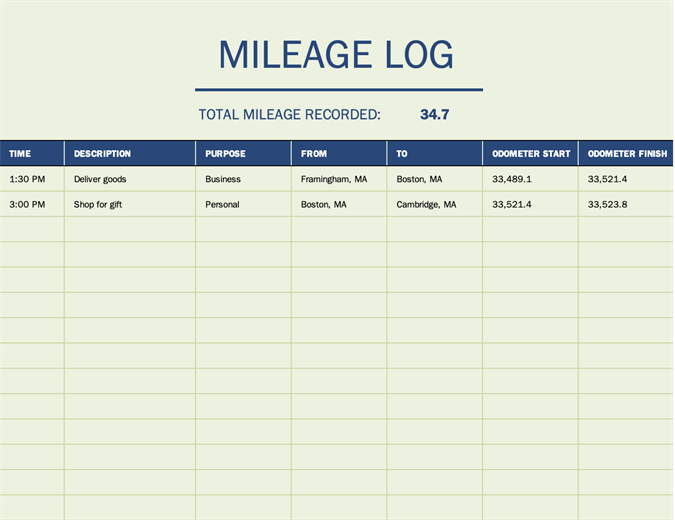

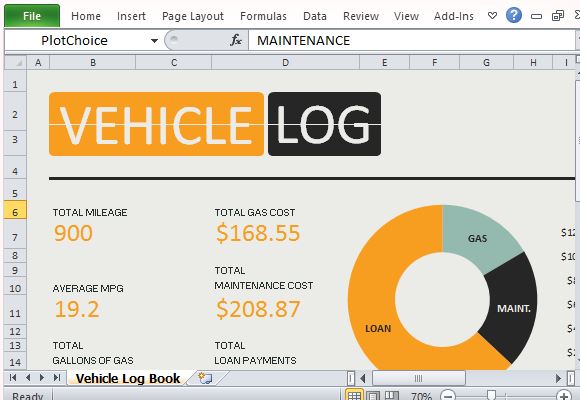

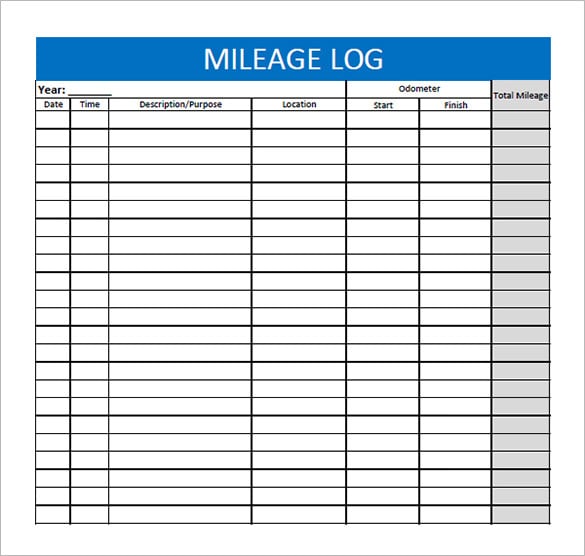

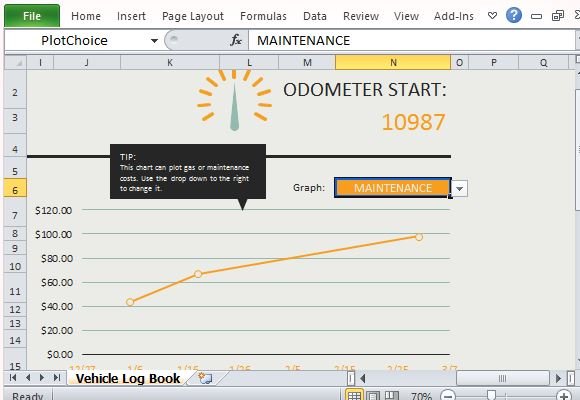

Log your mileage and gas expenses and watch this template calculate average price per gallon miles per gallon and cost per mile. Now you can easily get a mileage log template which you can use for the purpose you intended. The irs lets you deduct 545 cents per business mile. Mileage log track your mileage with this accessible spreadsheet with room for trip details and odometer start and finish readings mileage is calculated automatically.

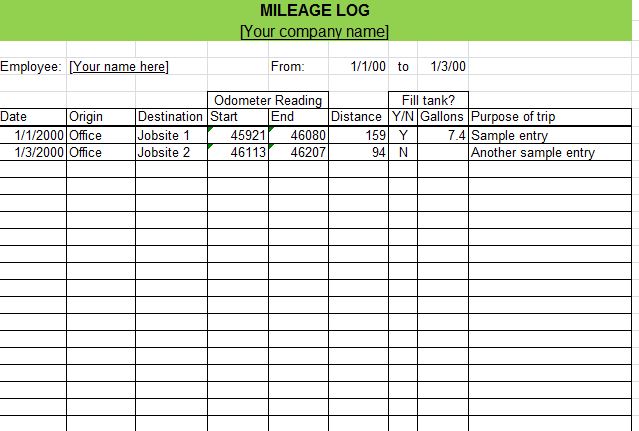

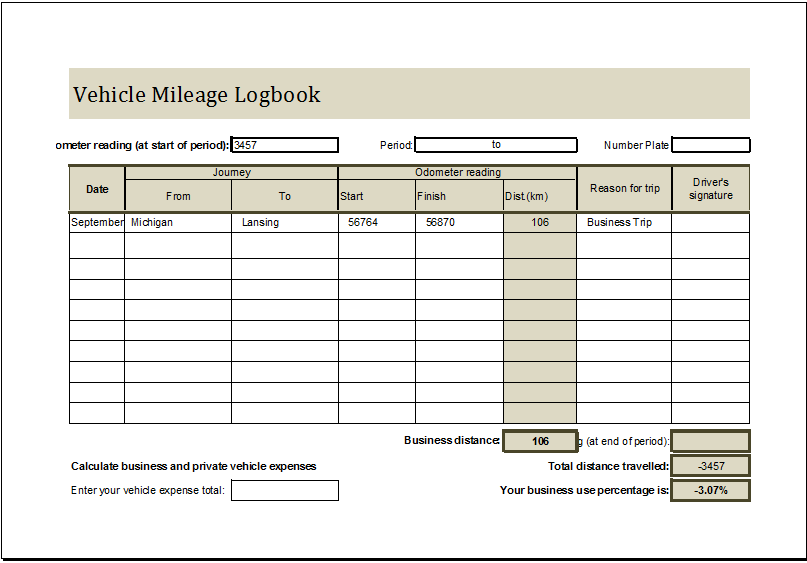

The customizable template for mileage log has built in formulas that calculate every detail about the mileage. The excel spreadsheet contains many columns where you can record different details which are necessary to track vehicle mileage. Therefore if you are ever in need of a mileage log template it is best to download it from the internet. In addition the templates calculate the total miles for the worksheet at the bottom of the mileage column.

If your company has a specific reimbursement form for you to use then keep a copy of vertex42s mileage tracking log in your car to track mileage at the source. Most templates provide a column for each of these numbers calculating your mileage for each trip based on the difference between the two column values. The mileage log is formatted for portability and can be easily kept in the car. You can use the following log as documentation for your mileage deduction.

Mileage log and expense report report your mileage used for business with this log and reimbursement form template. There are two methods of calculating mileage deductions.