How Do I Get My Personal Property Tax Receipt

Your feedback was not sent.

How do i get my personal property tax receipt. If you have separate taxing authorities you will have to go to each taxing authoritys office for the appropriate duplicate tax receipts. Louis city in which the property is located and taxes paid. Click on the link for personal propertymvlt and real estate. Obtaining a property tax receipt property tax receipts are obtained from the county collector or city collector if you live in st.

Go in person to the county tax office or each taxing authority to obtain a duplicate copy of your property tax receipt. Paying your tax bill. Go to the correct county courthouse and find the office for tax receipts. Select the tax bill payment option which is the 6 th option.

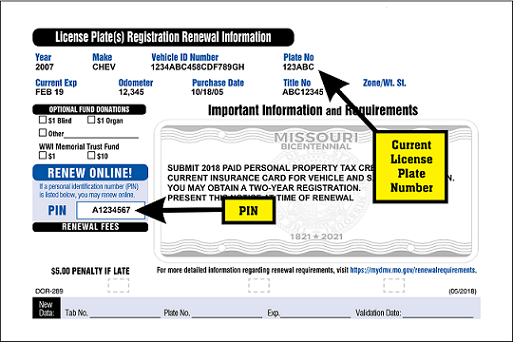

Louis county resident use the st. The official paid personal property tax receipt needed for license renewal will be mailed from the collectors office. After the payment has posted which can take up to five business days for online and telephone payments personal property tax receipts are available either by mail online or at our offices. You may click on this collectors link to access their contact information.

Click on the online services tab at the top of the website. The online payment transaction receipt is not sufficient for license plate renewal. The fee for debit cards is 150 and the fee for credit cards is 215. Louis county personal property tax lookup.

You can pay with a credit or debit card but there is a bank fee. Louis county resident use the st. Assessing personal property tax personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than december 31 each year. Your feedback was not sent.

If you have any questions you can contact the collector of revenue by calling 314 622 4105 or use the email form. Steps to viewprint property tax payment information. Account number number 700280. Check the building directory for the correct room if necessary or consult one of the security guards.

Missouri state statutes do not allow us to pay that fee for you like for profit retail establishments. Please allow 5 business days for mail time and for updating the state database. For example a payment mailed. If you have any questions you can contact the collector of revenue by calling 314 622 4105 or use the email form.

The united states postal service postmark determines the timeliness of payment. The official will then print a copy of your tax receipt. Account number number 700280. Louis county personal property tax lookup.

Present personal identification to the clerk such as your drivers license. We do not keep or gain from the fee in any way.