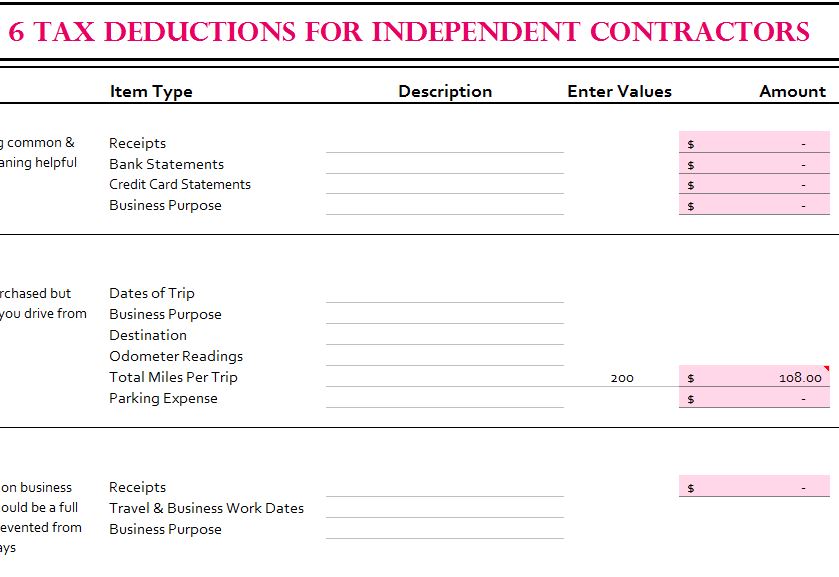

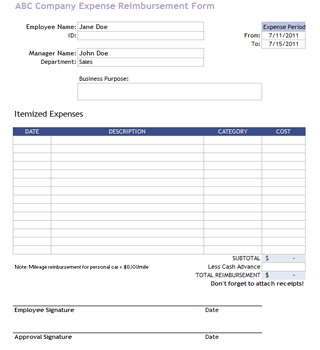

Itemized Tax Deduction Template

It only makes sense to choose the one that takes the most off your taxable income.

Itemized tax deduction template. A taxpayer needs to choose between itemized or standard deduction while filing the federal tax returns. You should itemize deductions if your allowable itemized deductions are greater than your standard deduction or if you must itemize deductions because you cant use the standard deduction. If the total amount of these expenses is greater than the standard deduction amount you should itemize instead of taking the standard deduction. You may be able to reduce your tax by itemizing deductions on schedule a form 1040 or 1040 sr itemized deductions pdf.

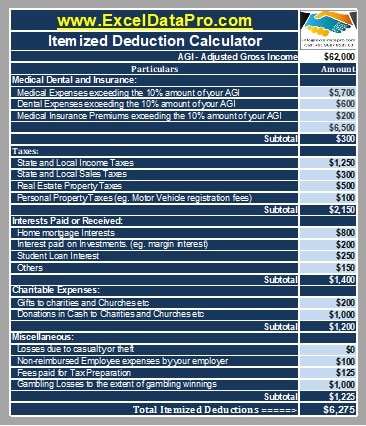

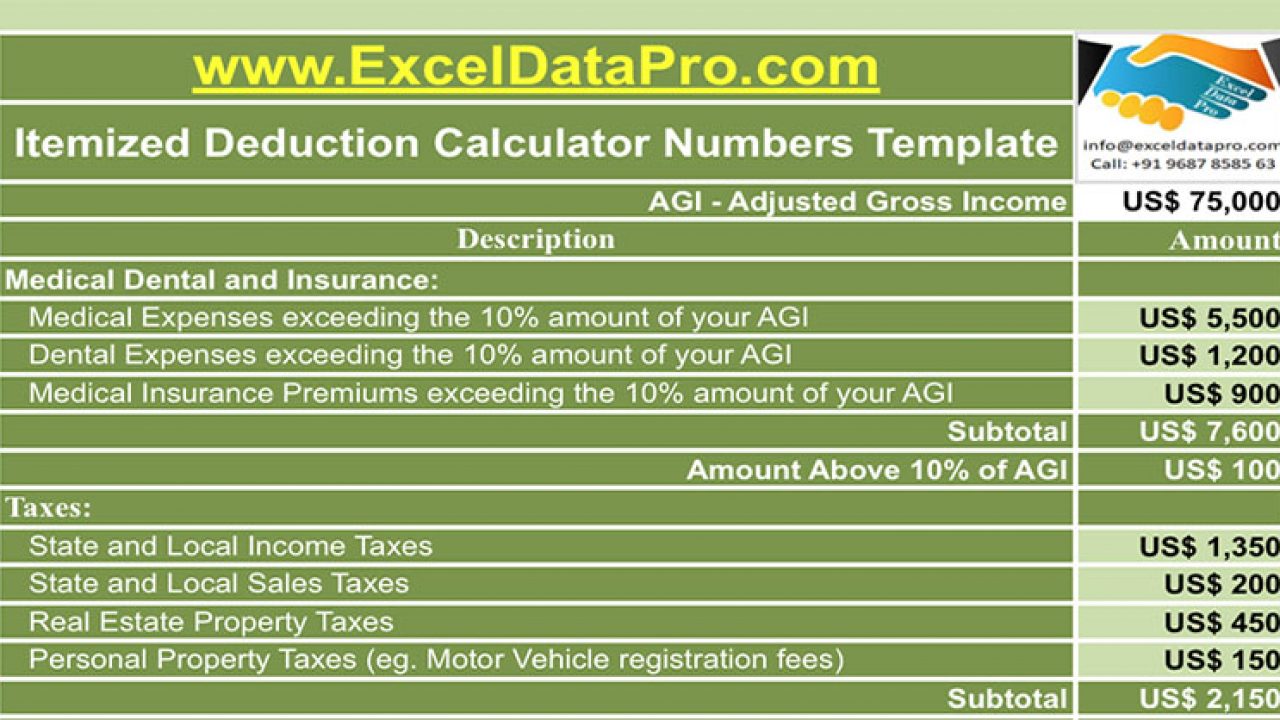

If you want to get your tax information organized for this year and every one after download the free template today. Itemized deductions calculator is an excel template. To download the same calculator in excel click the link below. It helps the taxpayer to choose between standard and itemized deductions.

Before you start e filing download or print this page as you collect forms receipts documents etc. 2019 2020 tax return checklist. Itemized deduction calculator excel template. The standard deduction and the total of your itemized deductions each reduce the amount of income on which you must pay federal income tax.

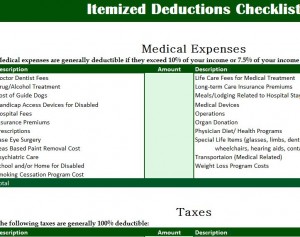

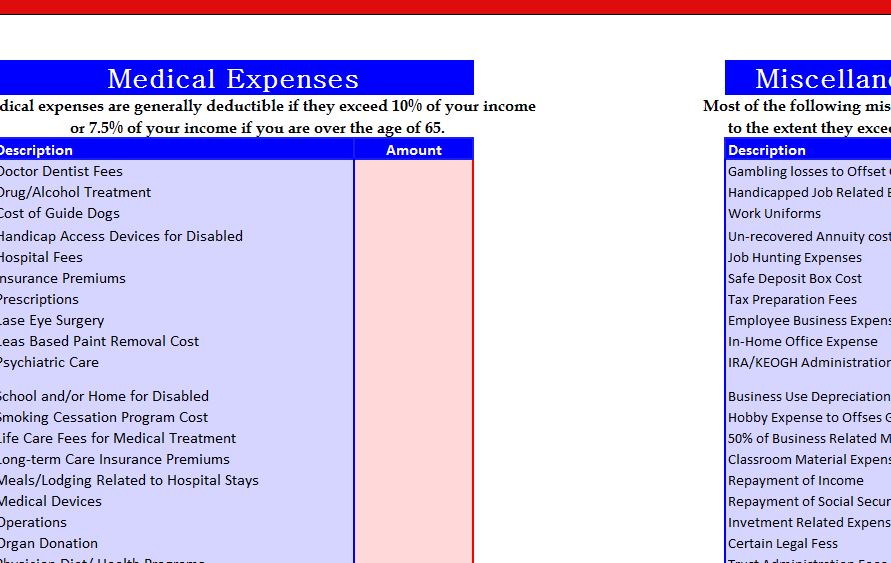

Itemized deductions checklist medical expenses medical expenses are generally deductible if they exceed 10 of your income or 75 of your income if you are over the age of 65. Necessary to prepare and e file your taxes. How to use the itemized deductions checklist. An itemized deduction template is an incurred expenditure which decreases an individual tax income and deduction from taxpayers taxable adjusted gross income that is made up of deductions of money spent or particular product or services during the year.

After downloading the free template to your computer you will automatically start on the first tab of the template. Itemized deductions are comprised of various types of certain expenses that you incur throughout the year things that aresurprise surprisetax deductible. It provides itemized checklists for all the above categories and can be instantly downloaded and used. If you miss an important form income deduction etc on your tax return you will have to prepare a tax amendment.

Generally dont e file before february 1 since most forms arrive by january 31. In addition to the above you can also download other numbers templates like simple tax estimator and section 179 deduction calculator. Some common medical expenses. Do you want to claim your deductions from medical expenses tax returns charitable contributions etc.