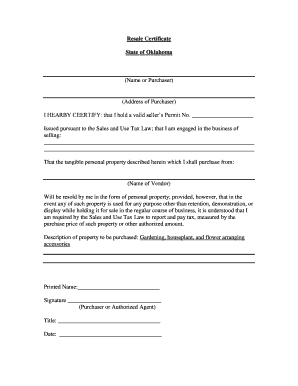

Oklahoma Resale Certificate

Oklahoma streamlined certificate notes.

Oklahoma resale certificate. Also known as. A new certificate does not need to be made for each transaction. Oklahoma sales tax vendor responsibilities exempt sales publication d revised may 2019. Issued pursuant to the sales and use tax law that i am engaged in the business of.

Even online based businesses shipping products to oklahoma residents must collect sales tax. Oklahoma equal opportunity education scholarship credit otc county apportionment for distribution of tax revenues top 100 delinquencies online services online filing businesses online business registration e file income sales use rate locator. Filling out the certificate is pretty straightforward but is critical for the seller to gather all the information. A seller who accepts an exemption certificate when the purchaser claims an entity based exemption.

Resale certificate state of oklahoma name or purchaser address of purchaser i hearby certify. Or where the nature of the business is such that a portion of its sales are for resale or are within. How to fill out the uniform resale certificate. Oklahoma tax exemption oklahoma resale certificate oklahoma sale and use tax oklahoma wholesale certificate etc.

Acceptance of uniform sales tax certificates in oklahoma. Most businesses operating in or selling in the state of oklahoma are required to purchase a resale certificate annually. If audited the oklahoma tax commission requires the seller to have a correctly filled out resale certificate. Oklahoma does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor.