Promissory Letter Template

How to modify the template.

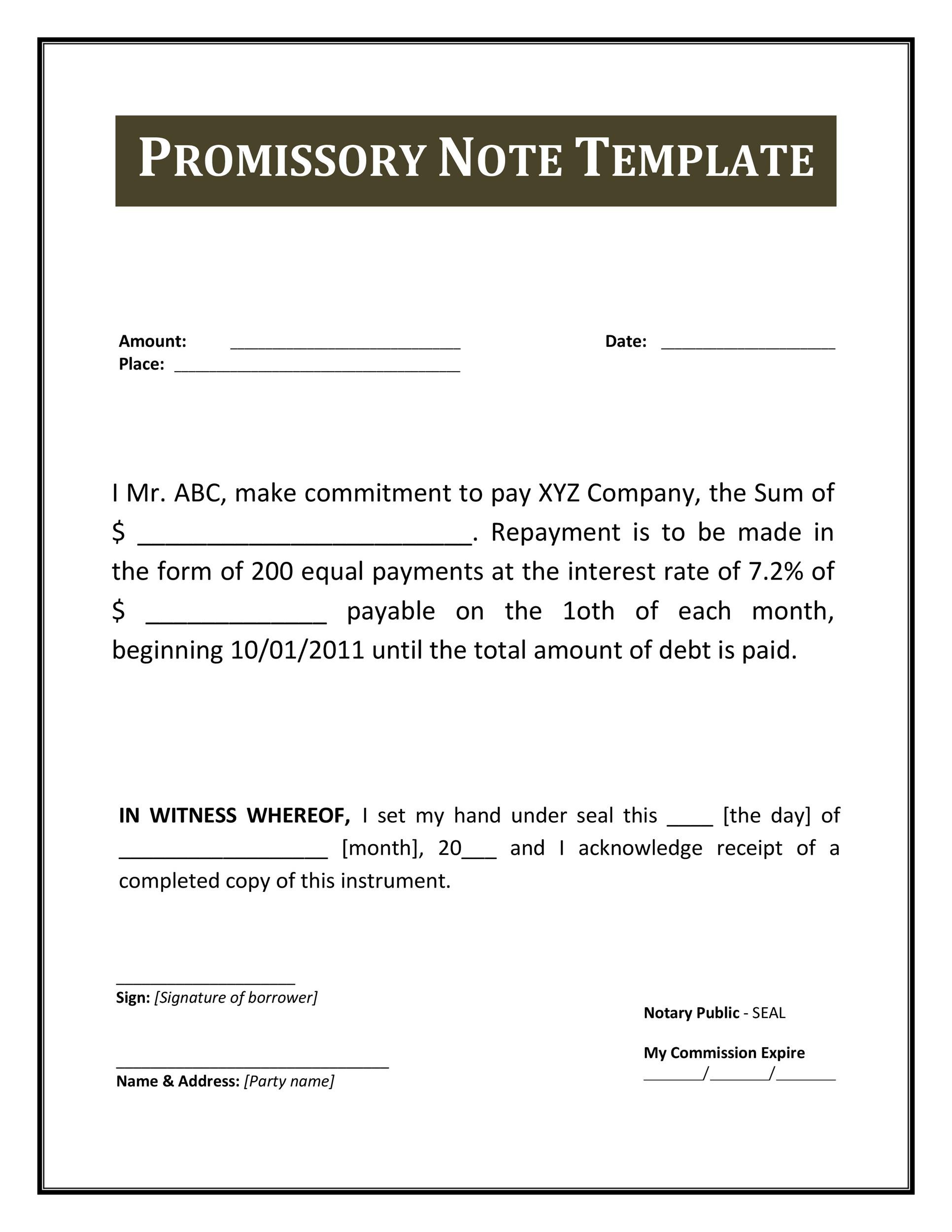

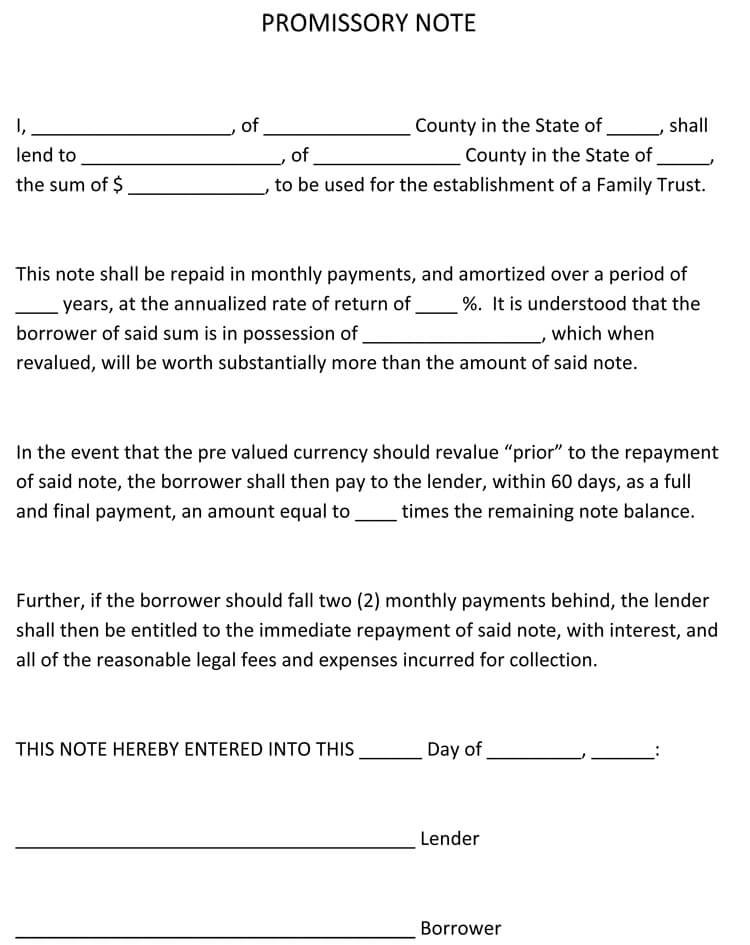

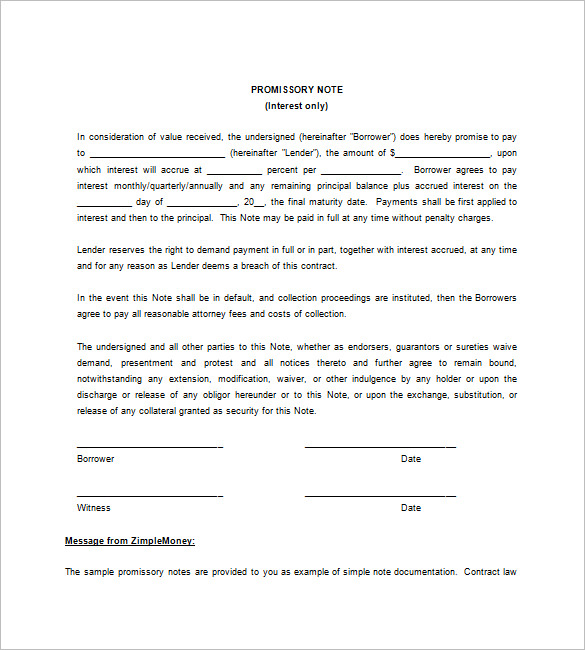

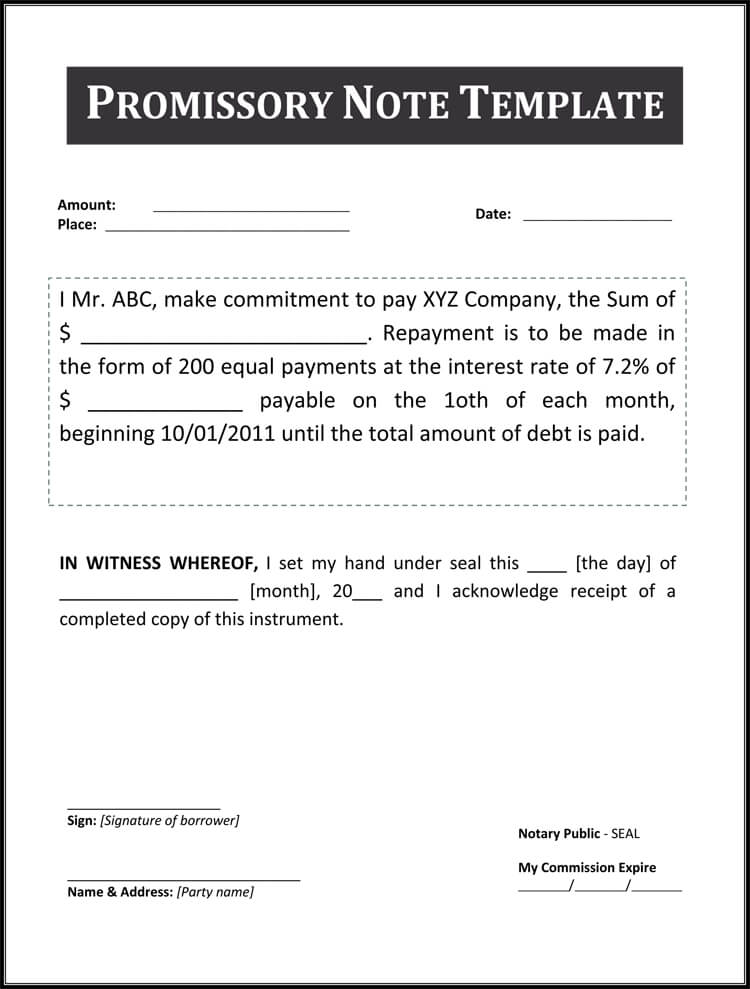

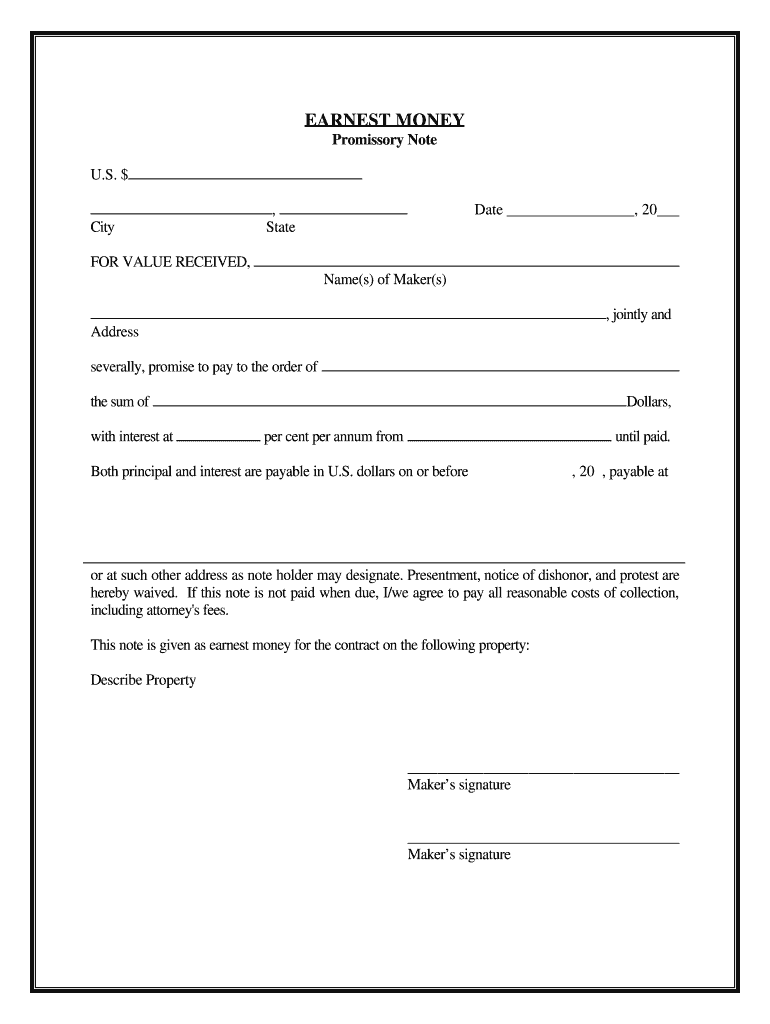

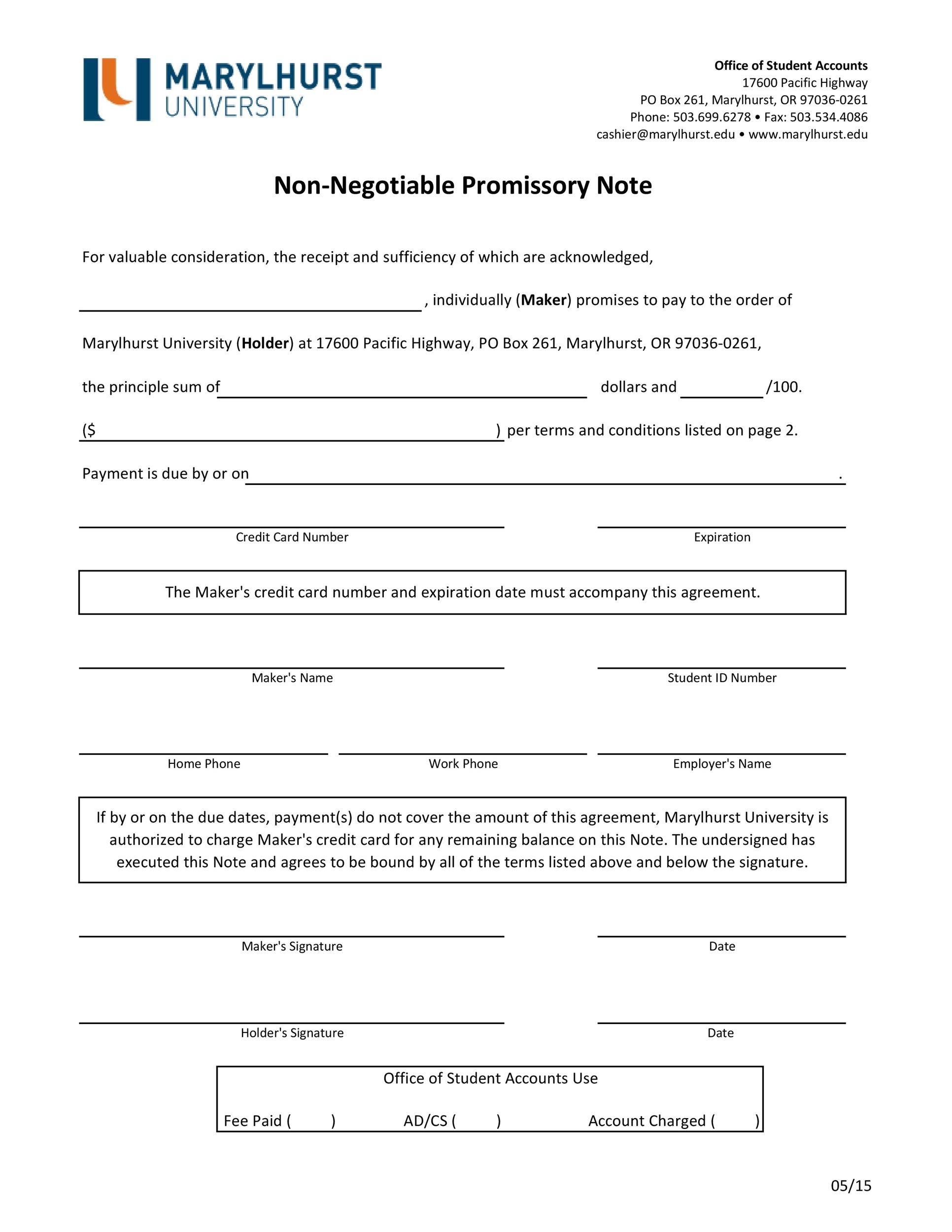

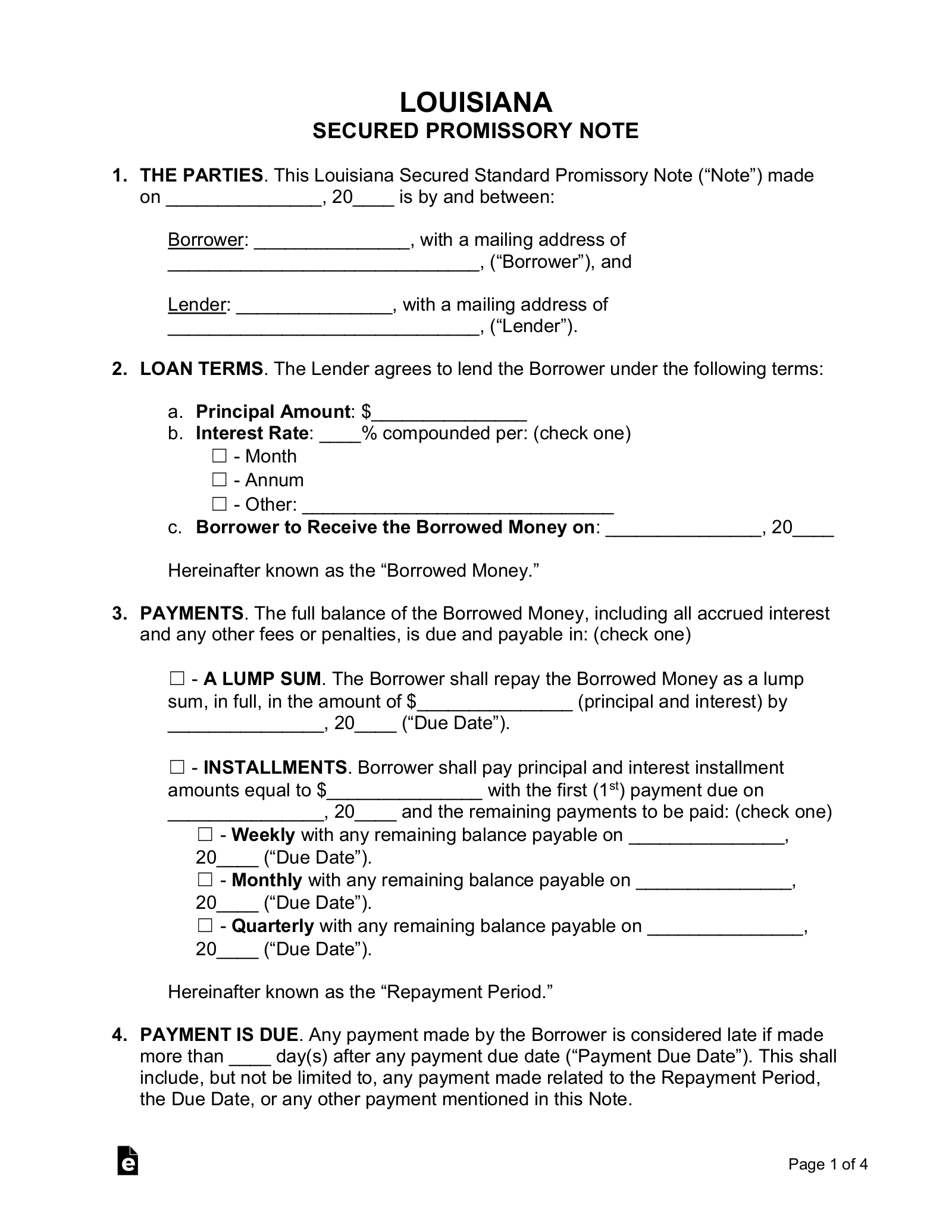

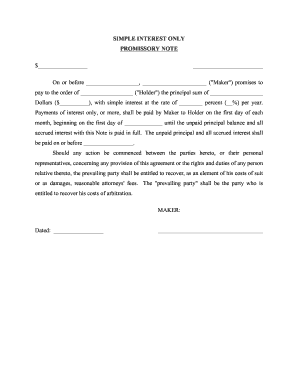

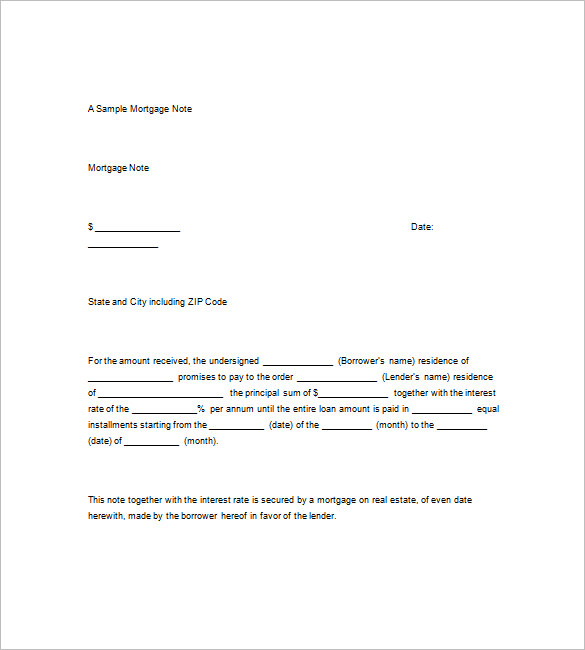

Promissory letter template. I borrowers name at borrowers address hereby promise to pay back in full the borrowed amount of borrowed amount plus interest to lenders name at lenders addressthis money will be used for purpose of borrowed moneythe first payment in the amount of amount plus interest must be paid by date of first payment and on the. Promissory notes are governed by article iii of the uniform commercial code the ucc. A promissory note recognizes a legally binding relationship between two parties a lender and a borrowertrue to its name it serves as a written and enforceable agreement that the borrower promises to pay the lender a sum of money within a specified period of time. A promissory note is a written promise issued by a borrower to a lender stating that the borrower will pay the stated amount of money at a later date.

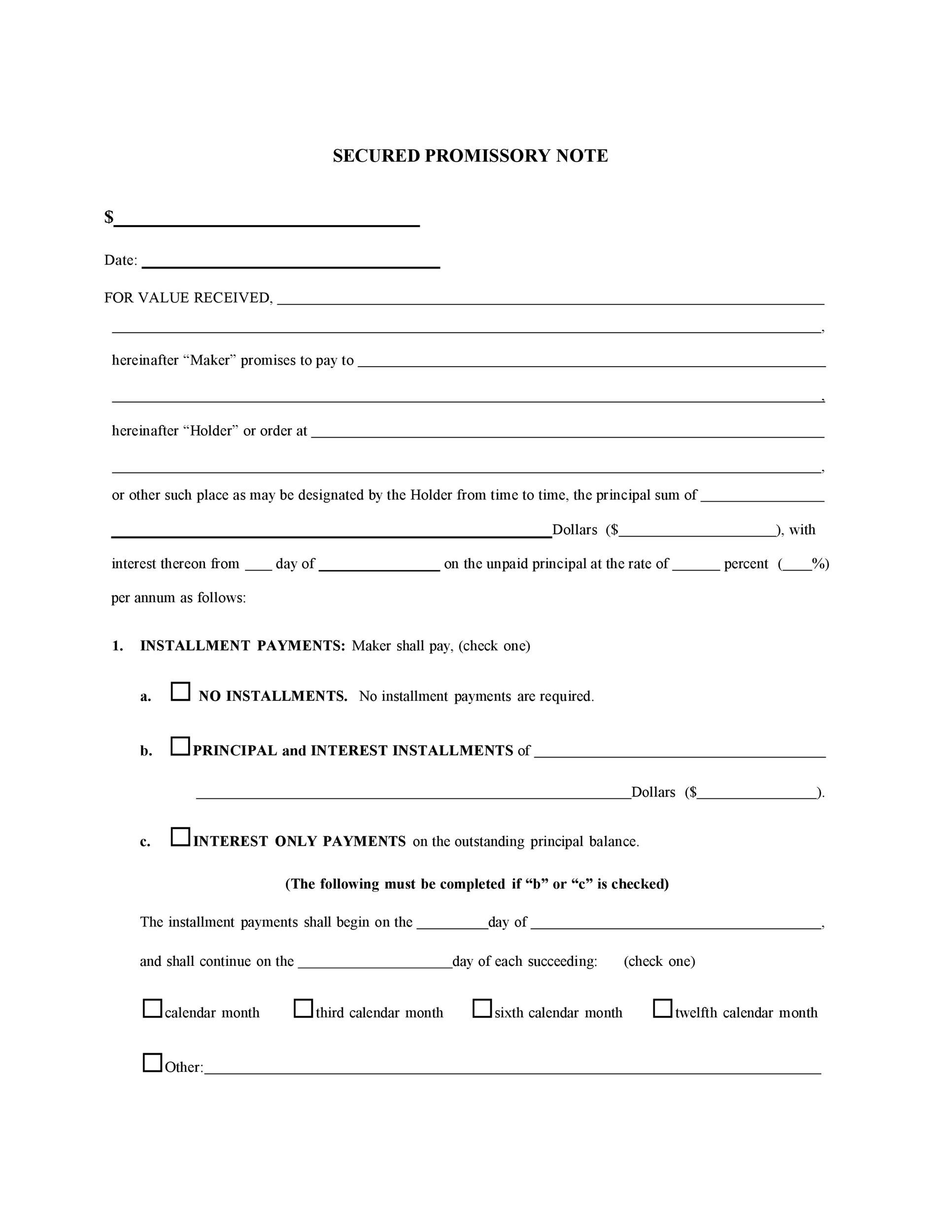

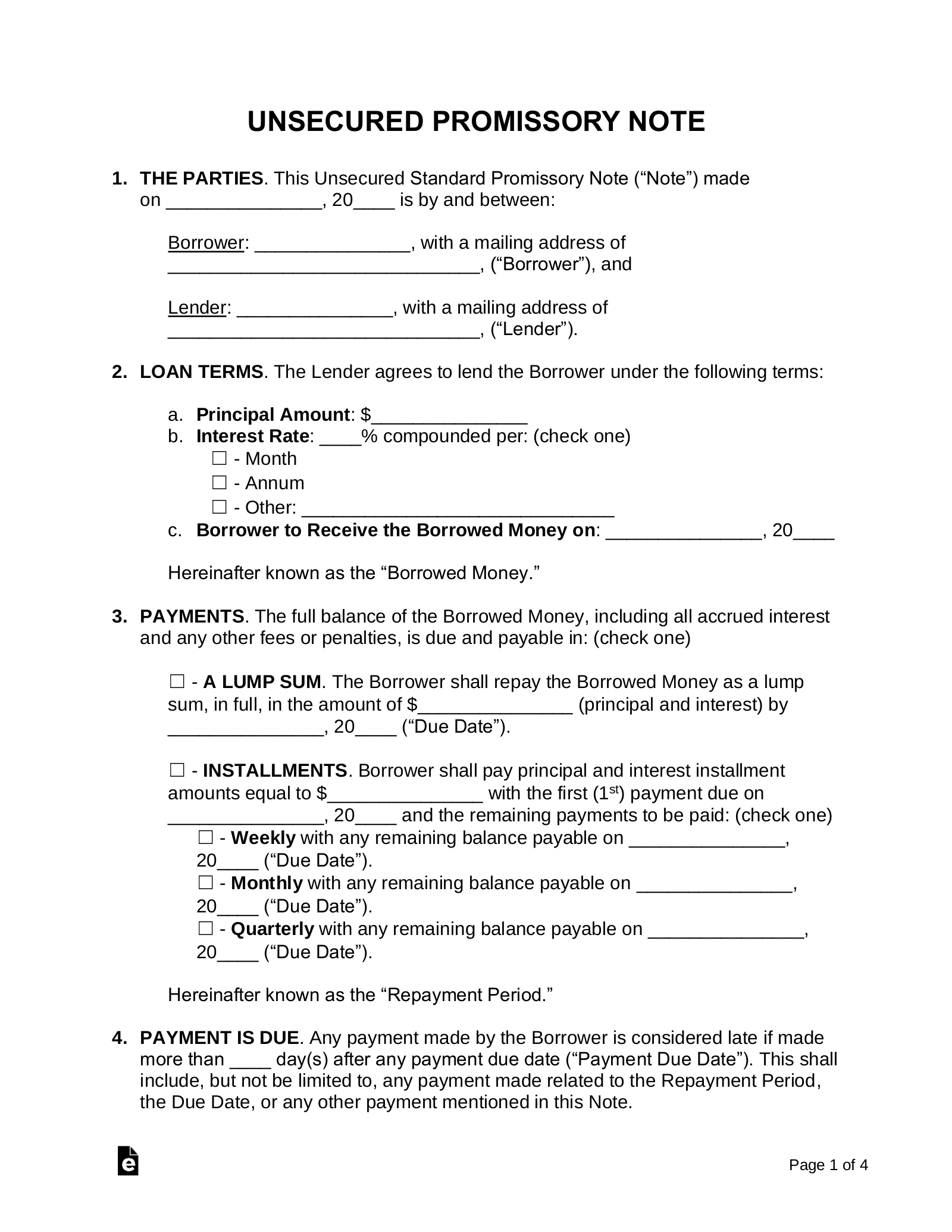

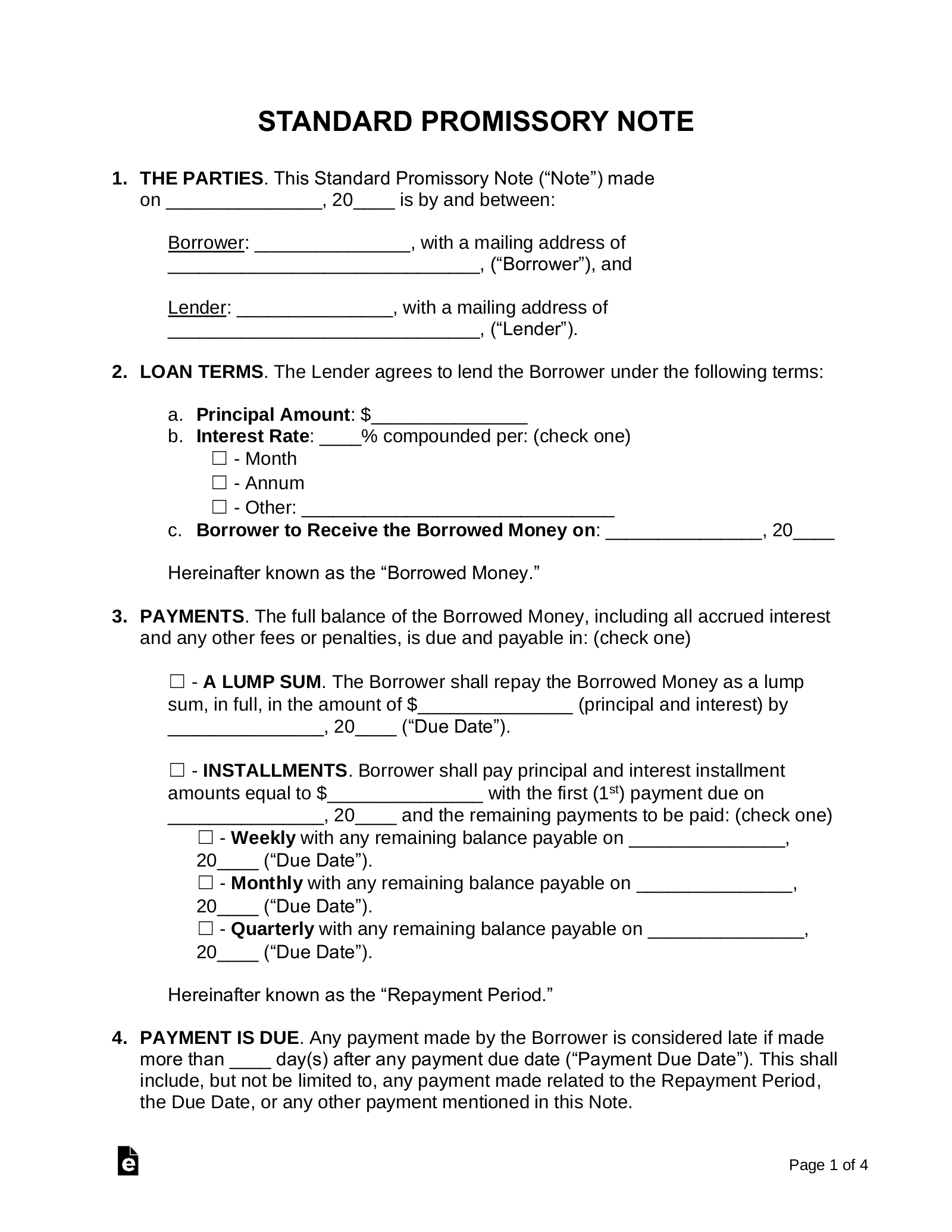

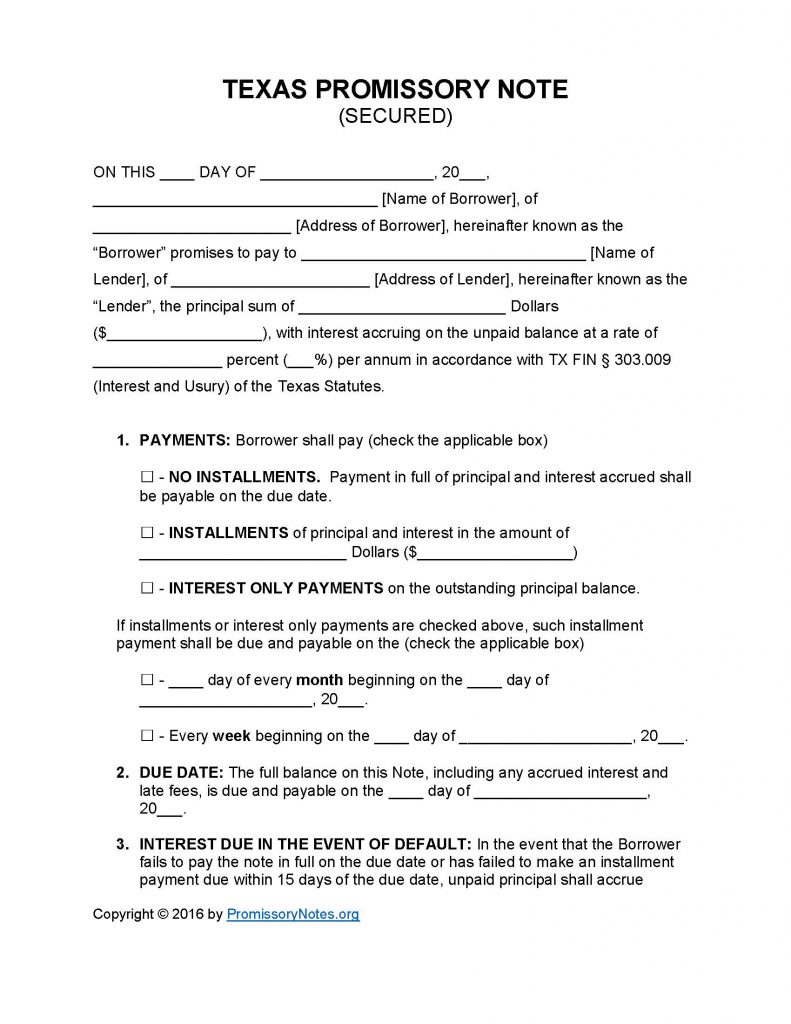

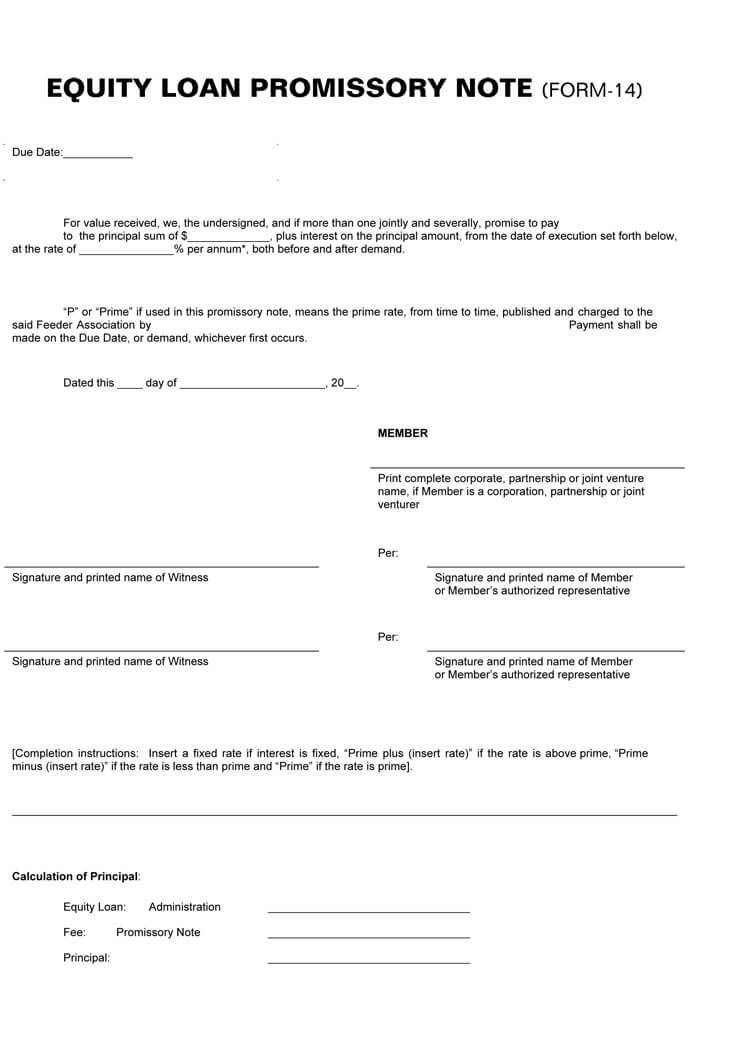

You fill out a form. There are 2 types of promissory notes secured and unsecured. Promissory notes are negotiable instruments that are saleable and unconditional and are used in business transactions around the world. Therefore to help business owners save time promissory note templates are available on the web for free.

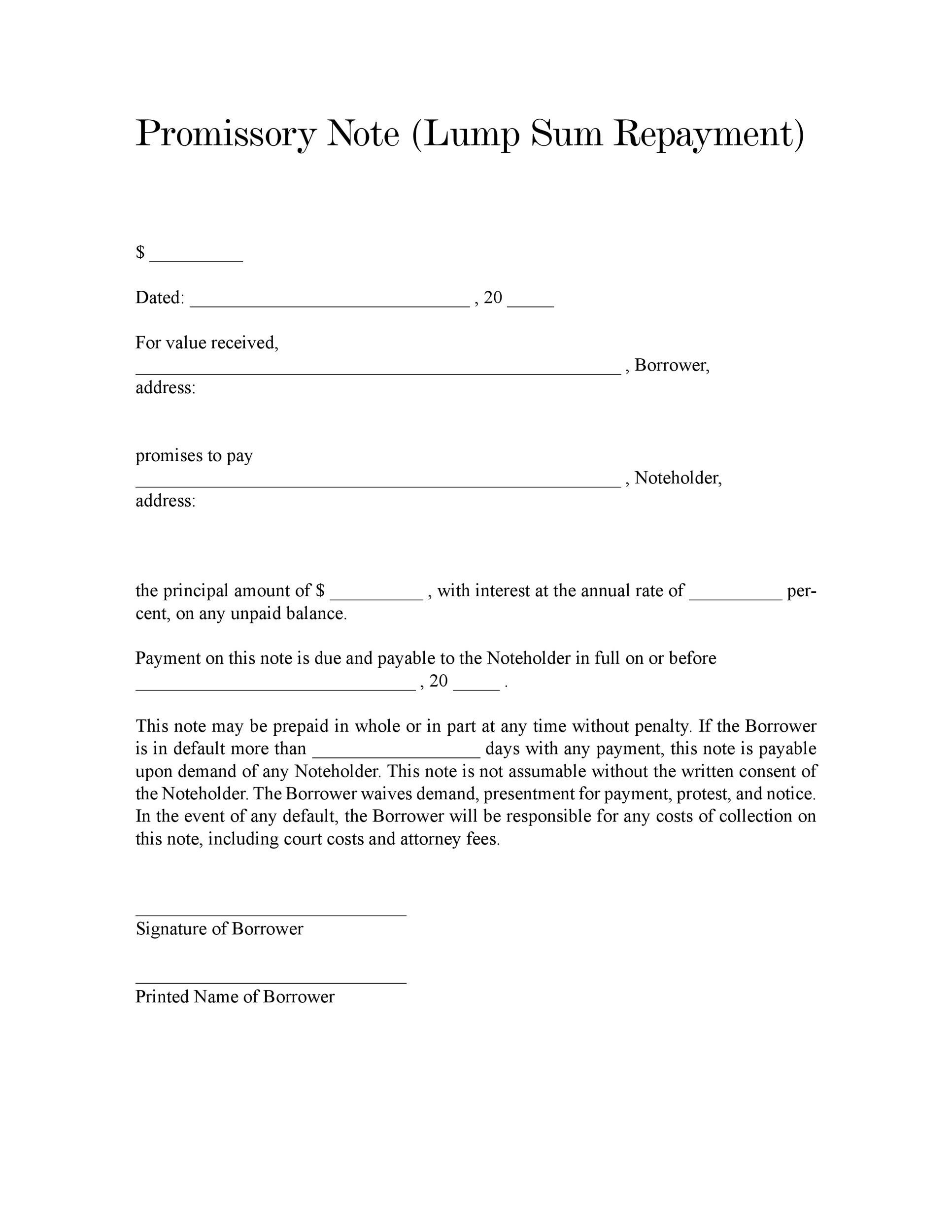

It is a financial tool and it shows the amount of cash the borrower should pay inclusive of interest at a future date. It is a promise to pay a loan made by the borrower. Scroll to the bottom for a blank repayment schedule that you can fill in. If this is the first time you are signing a promissory note then it is good to have a look at it before actually signing it.

The document is created before your eyes as you respond to the. Here is a promissory note template that might be used to sign an agreement or contract with you. The time period for repayment may be definitive or at lenders demand. What is a promissory note.

A promissory note or promise to pay is a note that details money borrowed from a lender and the repayment structurethe document holds the borrower accountable for paying back the money plus interest if any. For a more detailed loan an in depth loan agreement can be used. In this legal document one party promises to pay another involved party specific sum of money on mentioned time date or on demand. Just like any other promissory note the parties will fill details as required this is important for future reference.

Promissory notes are one the many financial instruments available in the market. A promissory note is required when you have to obtain loan or make promise for a financial transaction to a bank. One can use promissory note template word when giving away money to a family member or any other person for short period of time. A promissory note is a short succinct document for a loan.