Setting A Budget Worksheet

7 simple steps for setting up your budget free worksheets step 1.

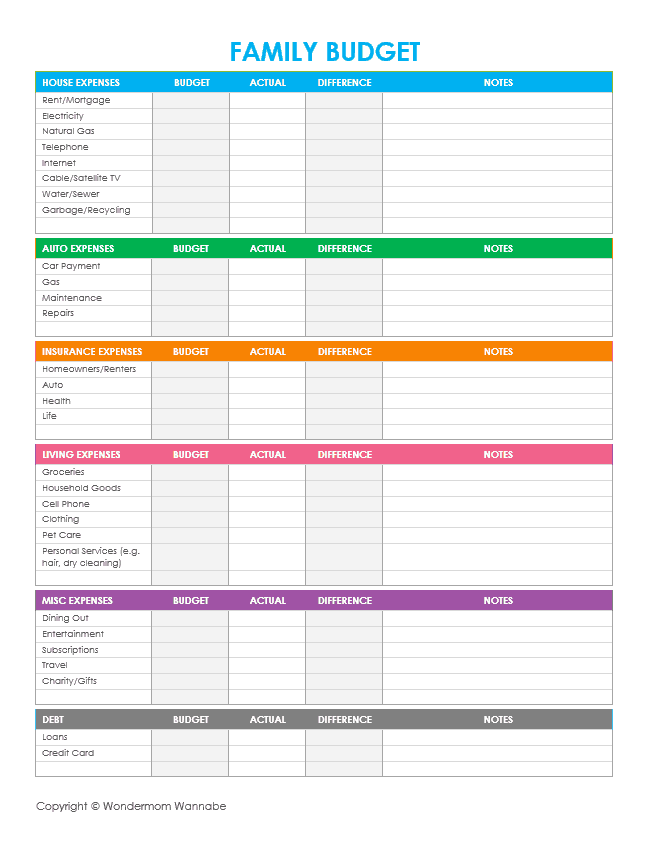

Setting a budget worksheet. When you do that you know that every dollar you make has a place in your budget. A good budget helps you reach your spending and savings goals. Also use the worksheet to plan for next months budget. This will give you a sense of where you are spending your money and changes you can make to improve your situation if necessary.

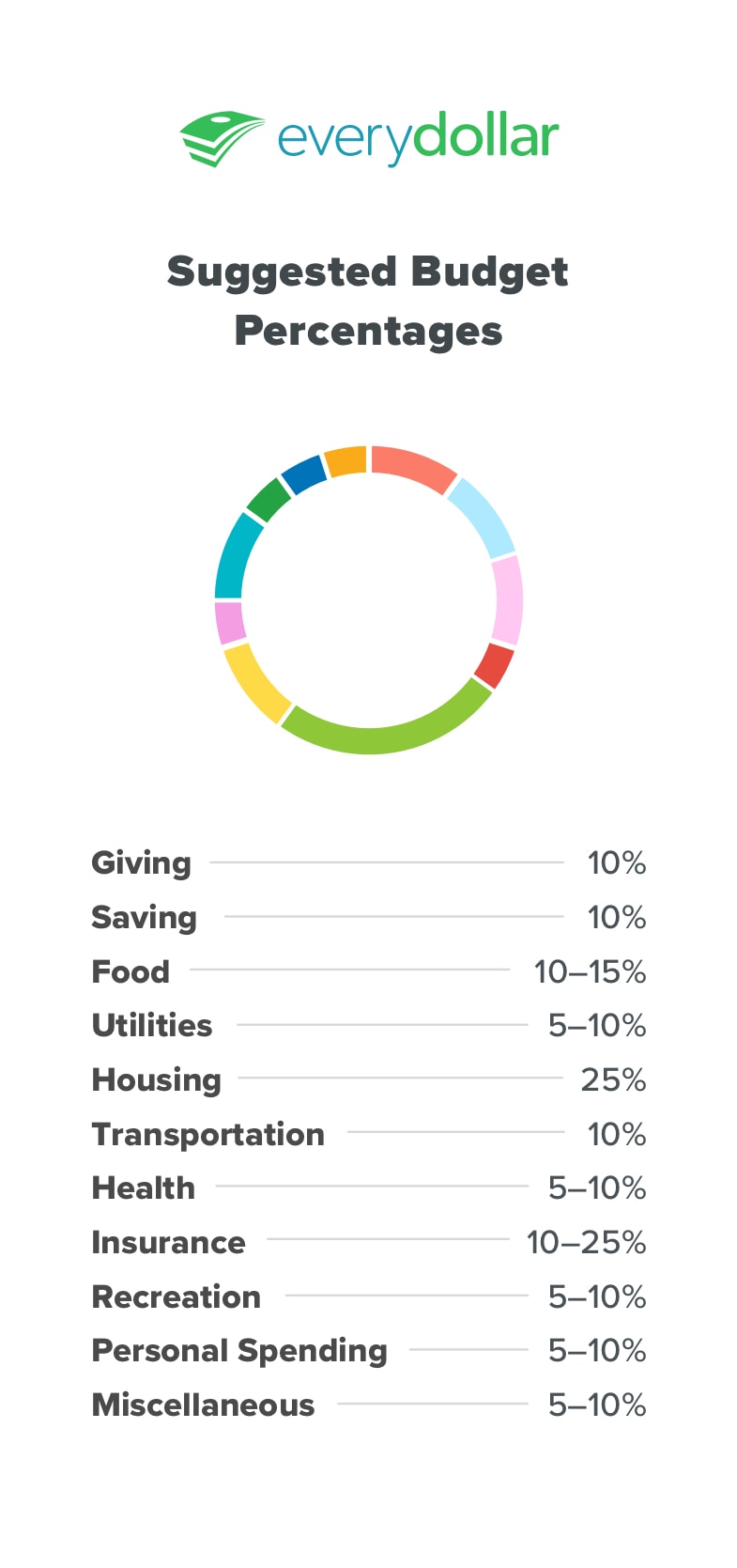

This worksheet is designed to give you a general idea of items you should include in your business budget. Depending on your business you may include additional types of income or expenses. We call this a zero based or everydollar budget meaning your income minus your expenses should equal zero. Comalpl lete that apply.

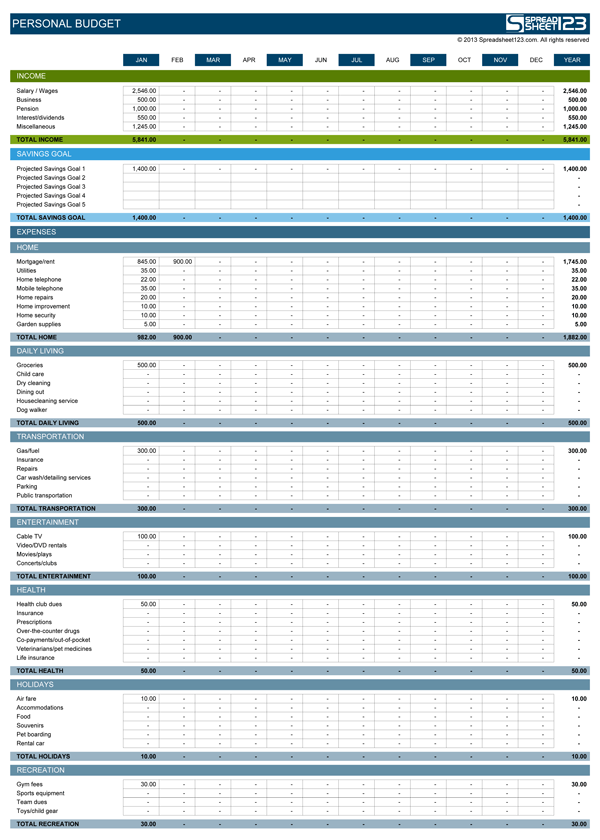

The following worksheet lays out the income statement line items you can use to set up a basic business budget. Figure out write down your monthly income. Every month put it in the other expenses this month category. Use this worksheet to see how much money you spend this month.

Budget for the month of notes. Before you start sifting through the information youve. Use this worksheet to see how much money you spend this month. Creating a budget step 1.

Figure out write down all of your expenses. Then use this months. Note your net income. Its helpful to keep track of and categorize your spending so you know.

Subtract expenses from income to equal zero. Write down all of the debts youre paying off. If you have an expense that does not occur. Getting your finances in order takes a load of stress off you when you feel in control of your money.

12 free printable budget worksheets to get control of your money. Work out a proposed household budget by inputting your sources of income and projected expenses into kiplingers exclusive worksheet below. Information to help you plan next months budget. Some bills are monthly and some come less often.

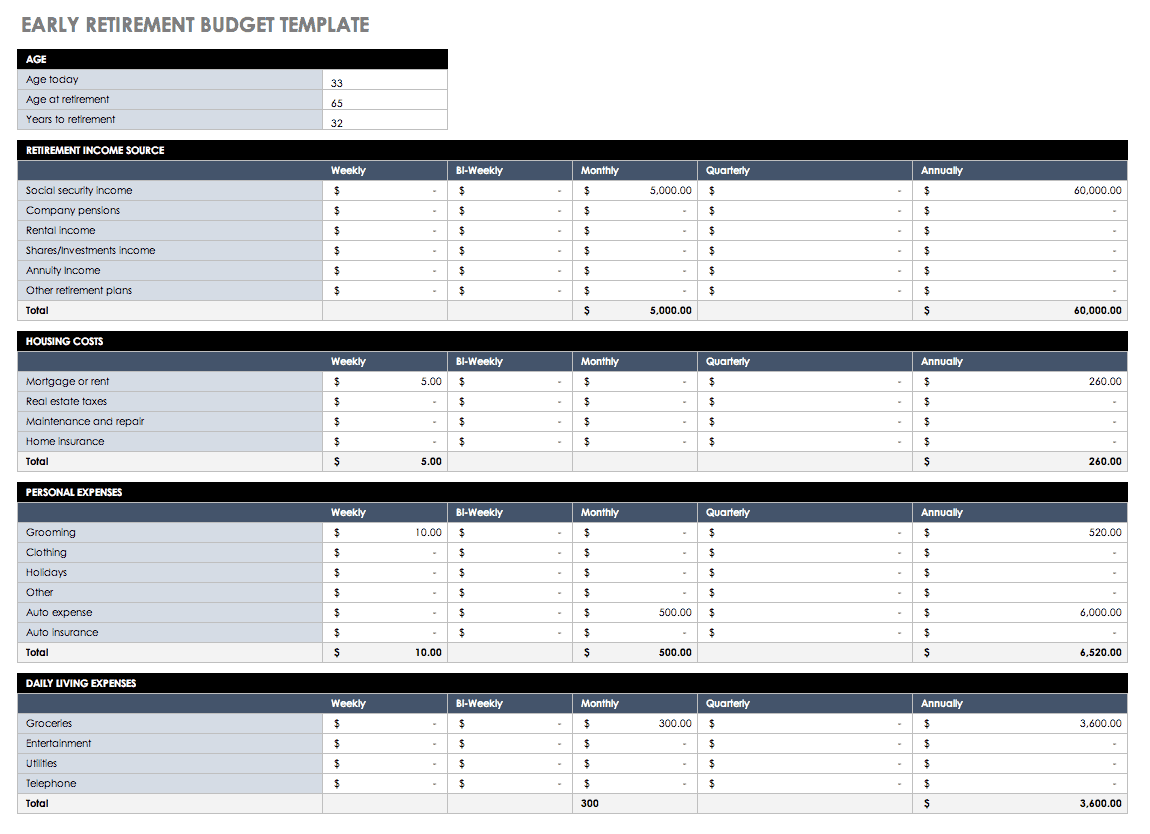

To get yourself organized youll need a way to track your budget. Though a monthly budget cycle is generally the most reasonable timeframe for which to set up an initial personal or household budget there are many sources of income and expenses that do not perfectly follow a monthly schedule. For instance you may receive a paycheck every week or two weeks not once a month. The first step in creating a budget is to identify the amount.

If youre over or under check your math or simply return to the previous step and try again.

:max_bytes(150000):strip_icc()/ScreenShot2019-10-03at11.23.50AM-3d49be3dc2e645dea0cb1ef4d829663b.png)