Deferred Revenue Recognition Template

This template is intended to be very straightforward with reasonable flexibility for various common billing frequencies.

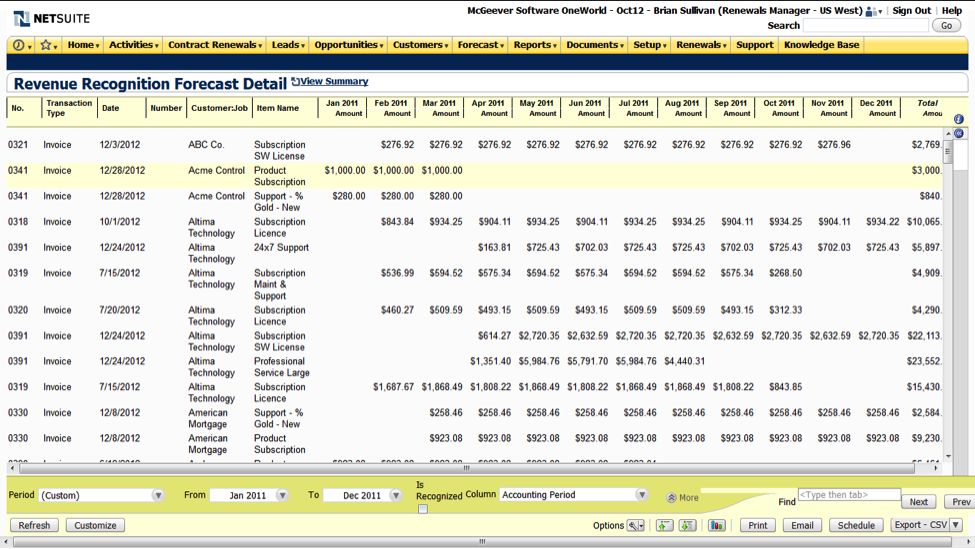

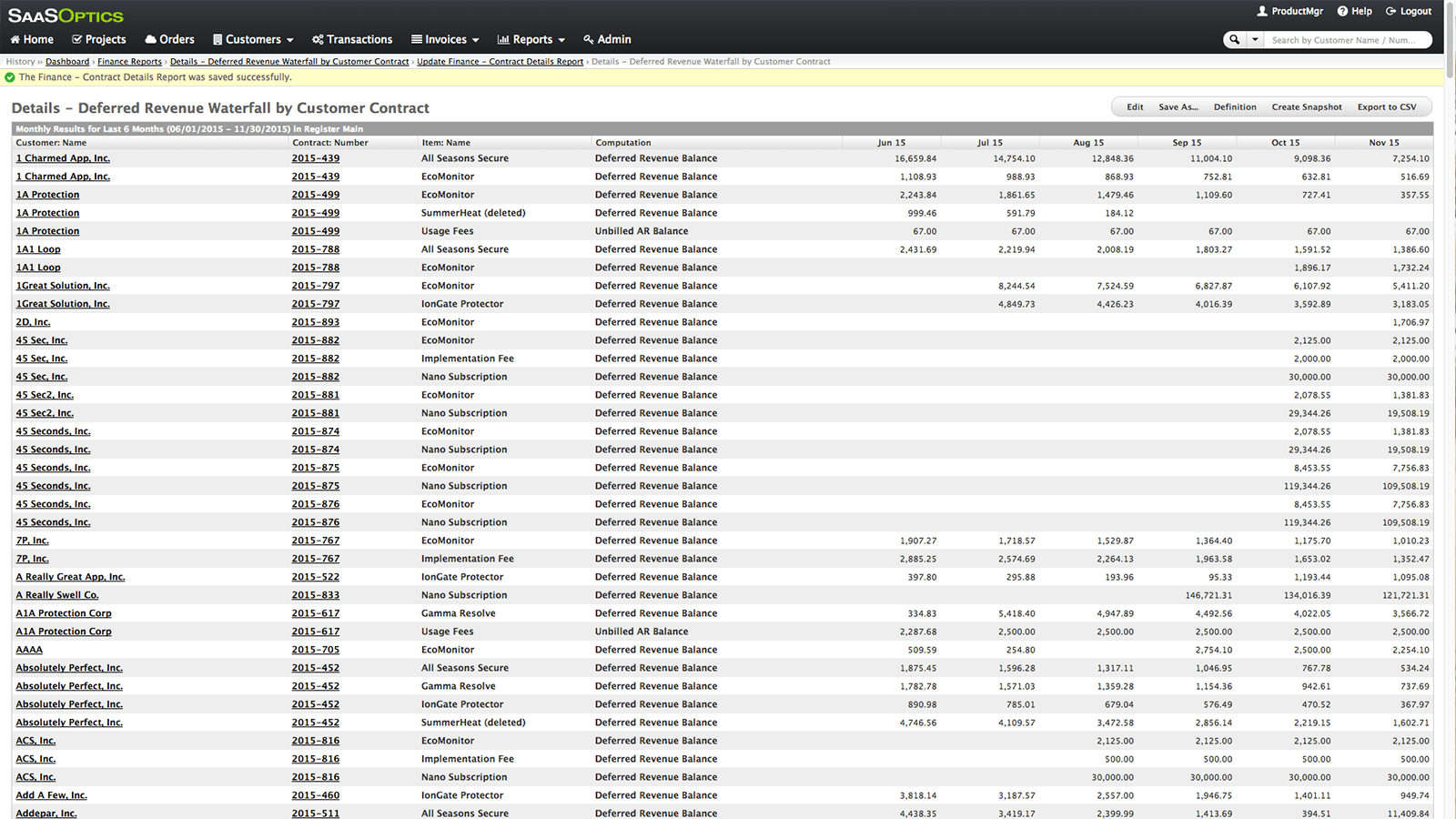

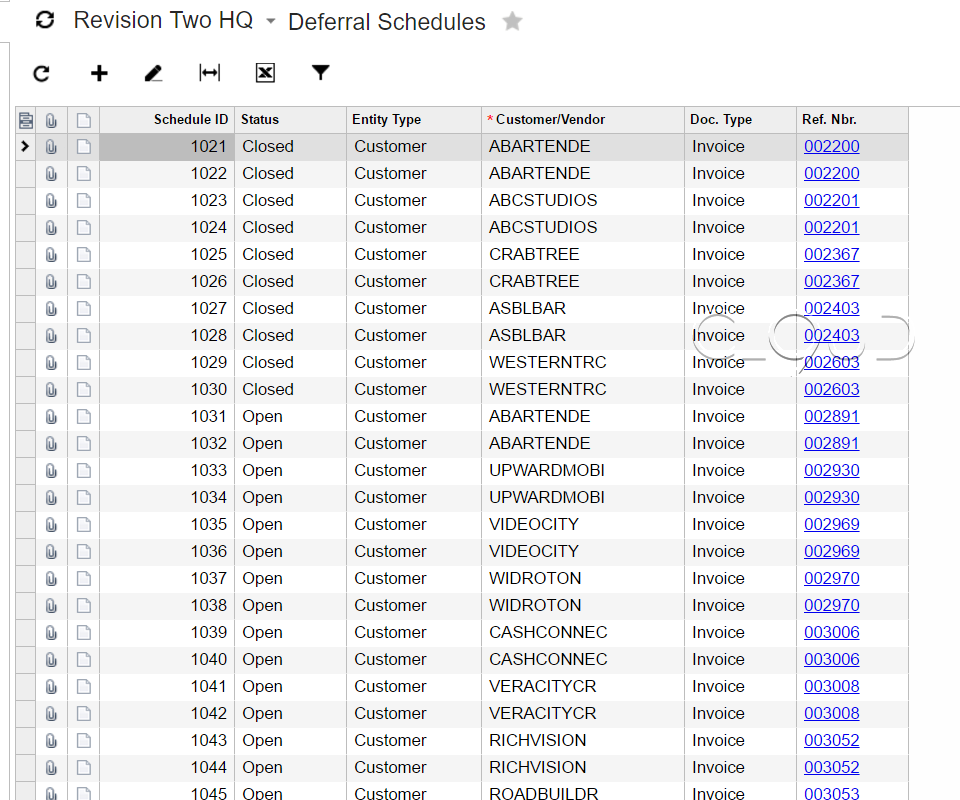

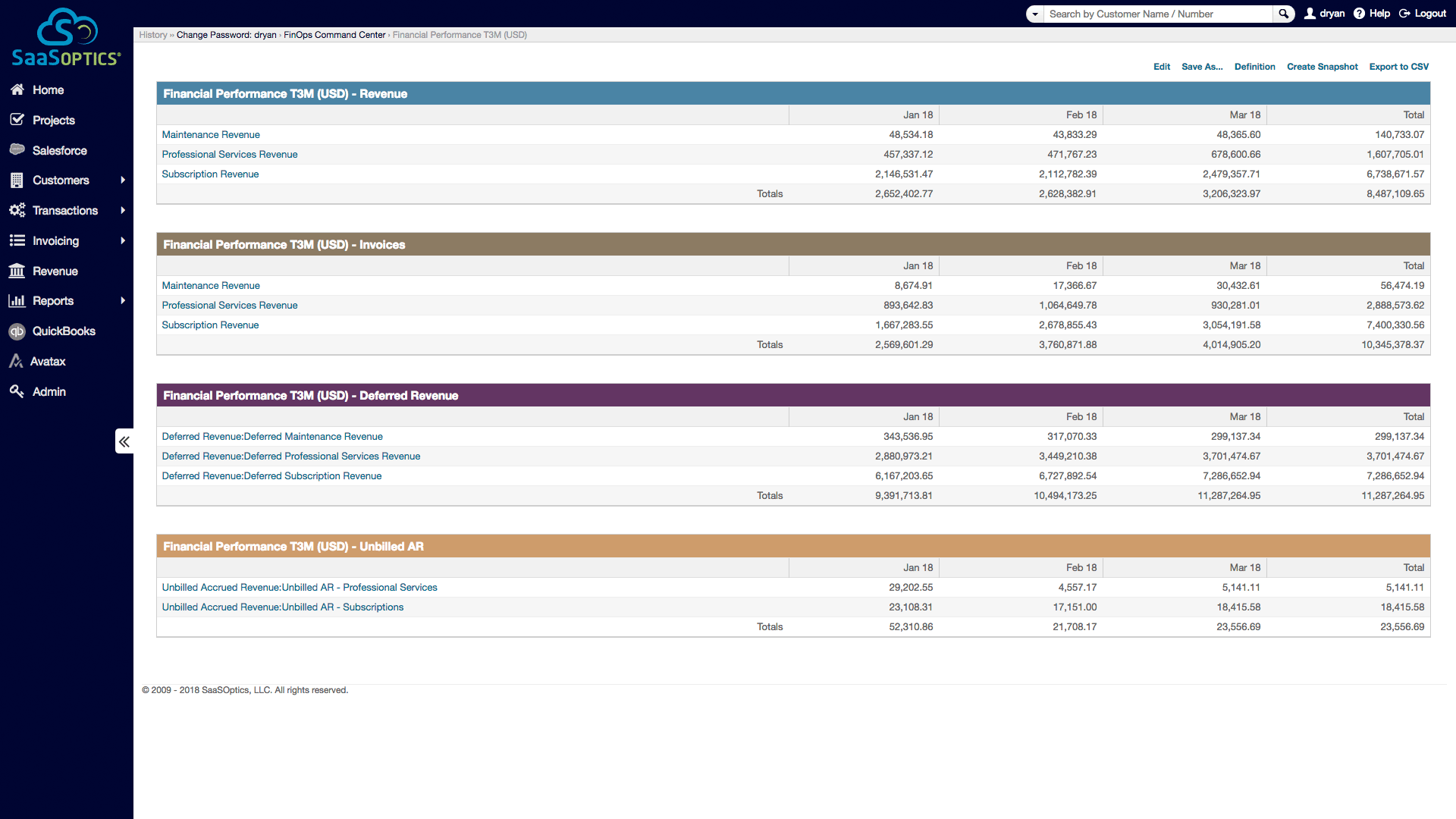

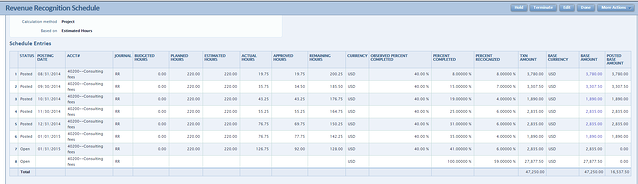

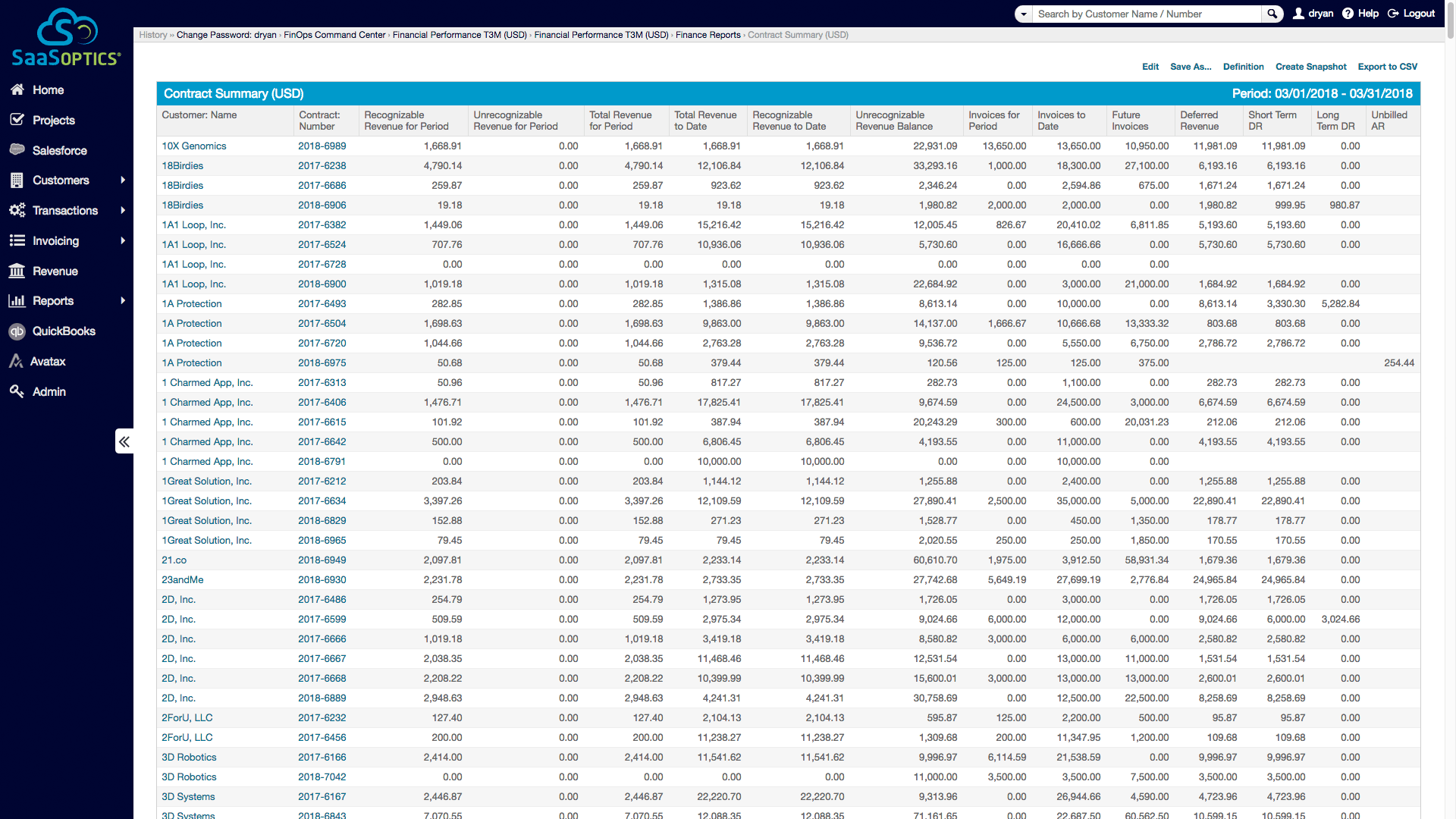

Deferred revenue recognition template. Manage delayed or inconsistent revenue recognition scenarios with ease in saasoptics. Deferred revenue model thanks for the reply but i actually need the invoice amount to be divided by the amortise number. Create templates that align with how and when you will invoice customers and recognize revenue based on milestones over the course of the customer relationship. Templates can be linked to accounts sub accounts and inventory components.

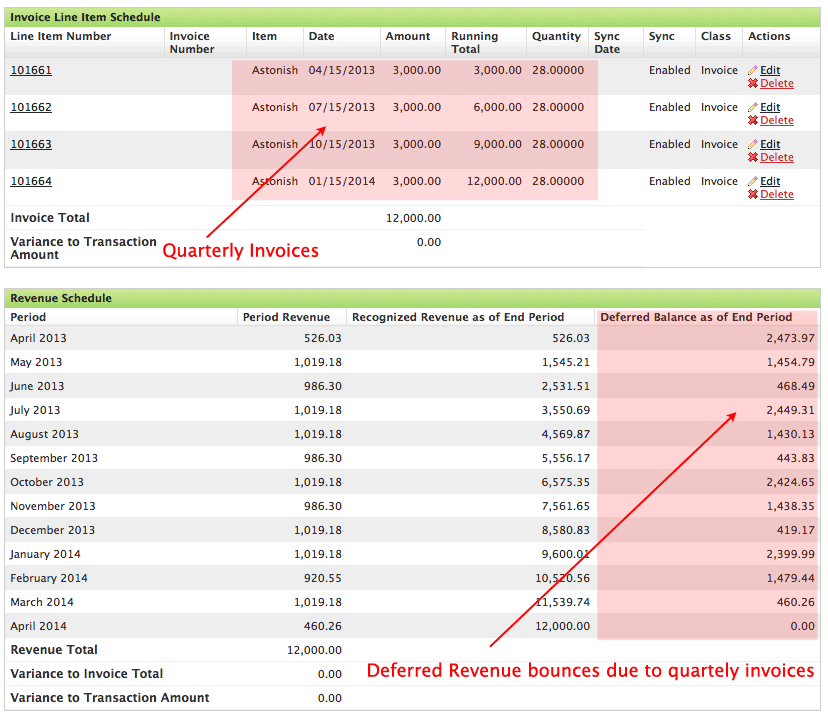

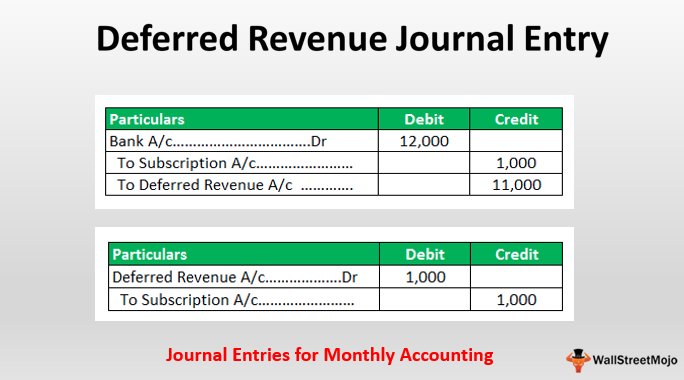

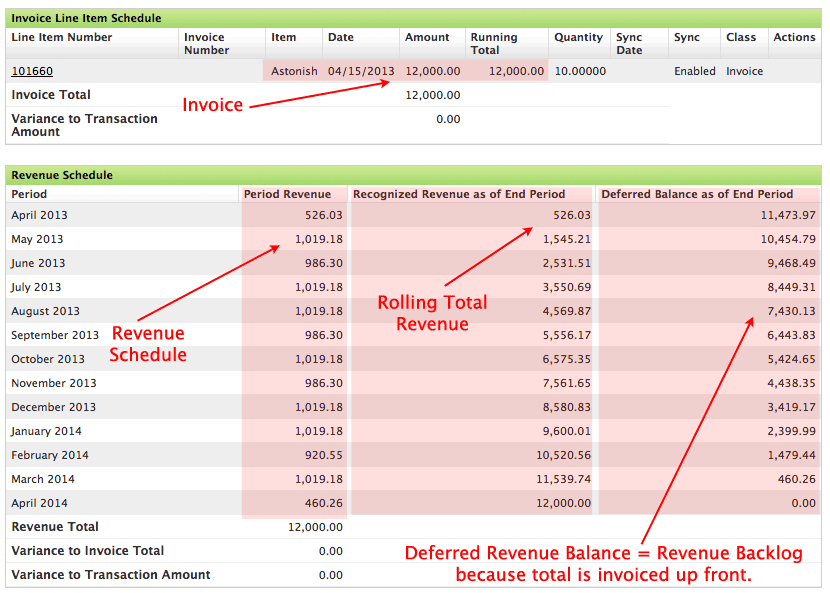

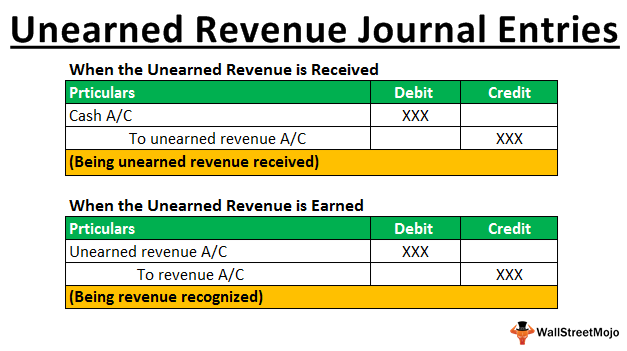

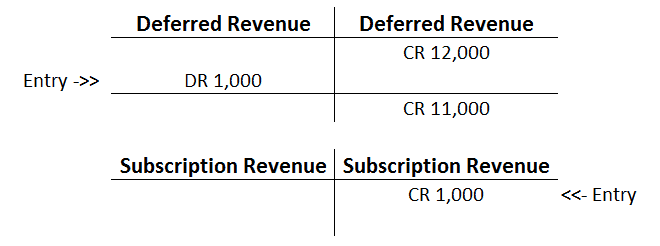

Deferred revenue recognition in a 2 way step. The following deferred revenue journal entry provides an outline of the most common journal entries in accounting. Such payments are not realized as revenue and do not affect the net profit or loss. So in the first example for joe i want to see 1000 divided by 8 and then that amount 125 to appear each month for 8 months until the amount is recognised in full and then of course i need it to start depending on.

When you post the related sales or purchase document the revenue or expense are deferred to the involved accounting periods according to a deferral. Create revenue recognition templates and assign them to line items on revenue transactions. It is not revenue for the company since it has not been earned. In simple terms deferred revenue means the revenue that has not yet been earned by the productsservices are been delivered to the customer and is receivable from the same.

Deferred revenue journal entry definition. A template can specify start date recognition method percentage to recognize immediately number of occurrences and time within the period to generate transactions. The simple answer is that they are required to due to the accounting principles of revenue recognition. Deferred revenue or deferred income should be recognized when the company has received payment in advance for a productservice to be delivered in future.

This is because it has an obligation to the customer in the form of the products. Provide leaders at businesses that sell annual saas or software subscriptions with a simple tool for managing their revenue recognition needs. To recognize subscription revenue properly it is important to track four key. Download cfis deferred revenue template to analyze the numbers on your own.

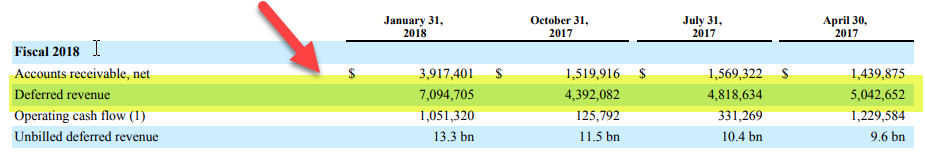

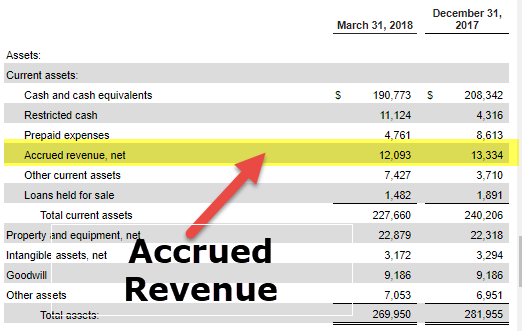

A 5 year building rent agreement may specif free sample rental property schedule template free rental property schedule template track the revenue and expenses and profit or loss of each of your rental properties using our free rental property schedule. Just as expenses are accrued and smoothed out over time so are revenues. Why companies record deferred revenue. Deferred revenue is recognized as a liability on the balance sheet of a company that receives an advance payment.