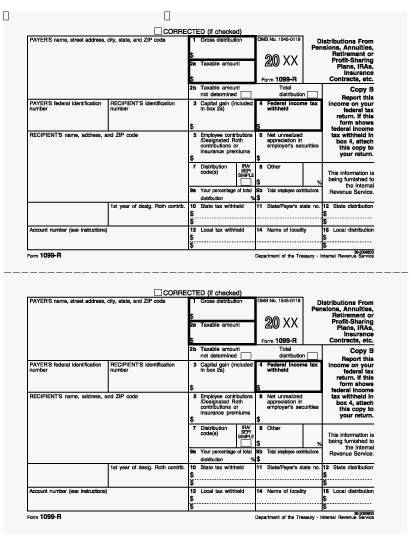

Printable 1099 Form For 2019

Get 1099 form for 2019 instructions requirements print form and more for every 1099 form type.

Printable 1099 form for 2019. It is a required tax document if a non employee such as a contractor or freelancer makes more than 600 from the company or individual issuing the document. Checked the payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. Payer is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. May show an account policy or other unique number the payer assigned to distinguish your account.

Instantly send or print your documents. See the instructions for form 8938. You also may have a filing requirement. For all other reported payments form 1099 misc must be filed by february 28 2020 if filed on paper or by march 31 2020 if filed electronically.

What is a 1099 misc form. It details the income and also notes that you have not deducted any federal state or other taxes from the income. E file to the irs at just 149form before the deadline april 01 2019 form 1099 misc is a printable irs information return that reports income for services performed for a business by an individual not classified as an employee. The irs form 1099 misc due date is january 31 2020 if you are reporting nonemployee compensation nec payments in box 7 whether the filing is done on paper or electronically.

Choose the fillable and printable pdf template. Create complete and share securely. The 1099 misc is used to report income. You also may have a filing requirement.

Amounts shown may be subject to self employment se tax. Report income from self employment earnings in 2019 with a 1099 misc form.