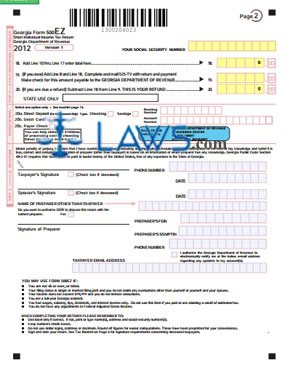

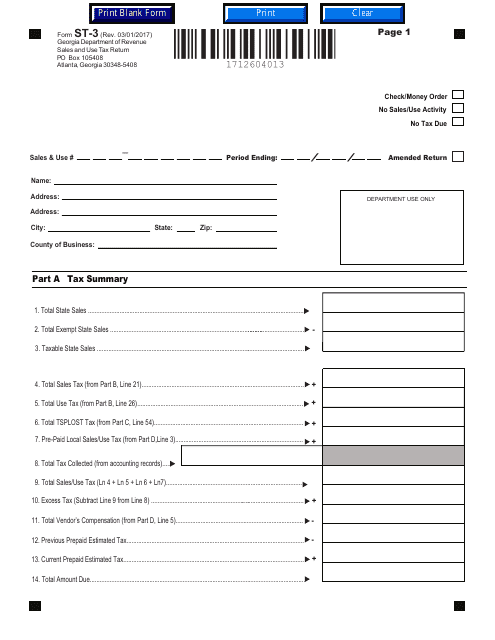

Printable Georgia State Tax Forms

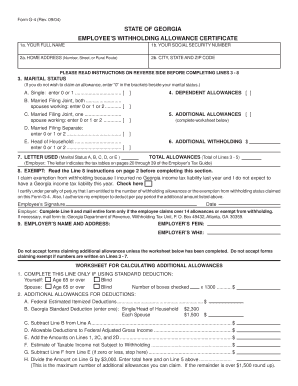

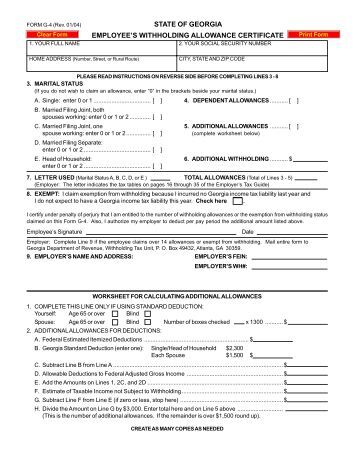

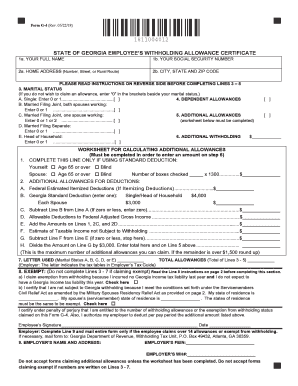

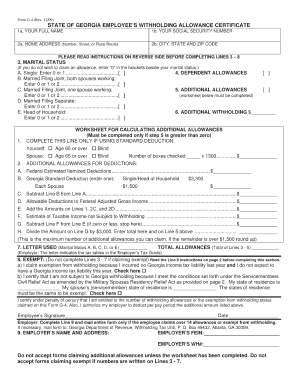

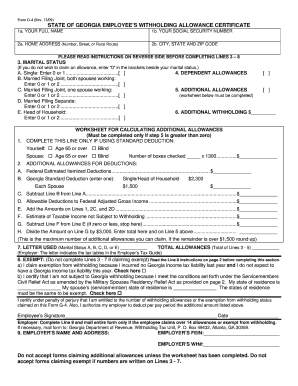

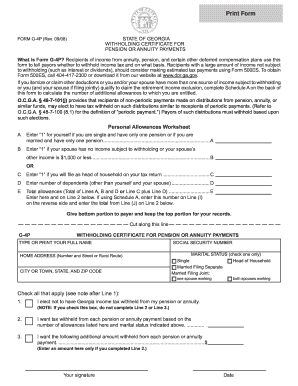

Form g 4 employee withholding georgia department of revenue skip to main content.

Printable georgia state tax forms. This form is for a net operating loss carry back adjustment by an individual or fiduciary that desires a refund of taxes afforded by carry back of a net operating loss. Call 1 800 georgia to verify that a website is an official website of the state of georgia. Form g4 is to be completed and submitted to your employer in order to have tax withheld from your wages. Medical exemption to window tint law.

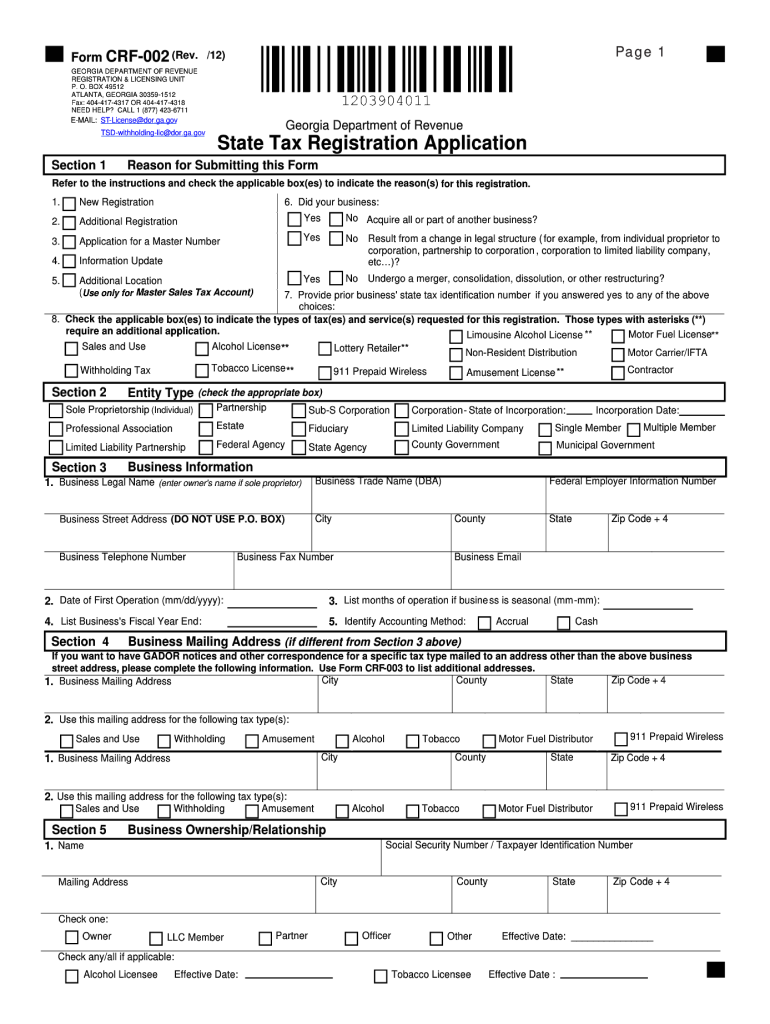

Form mv 1 motor vehicle titletag application original or replacement. The https ensures that any information you provide is encrypted and transmitted securely. The georgia income tax rate for 2018 is progressive from a low of 1 to a high of 6. The site is secure.

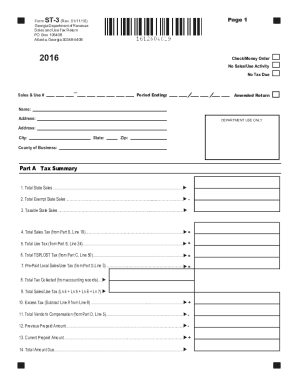

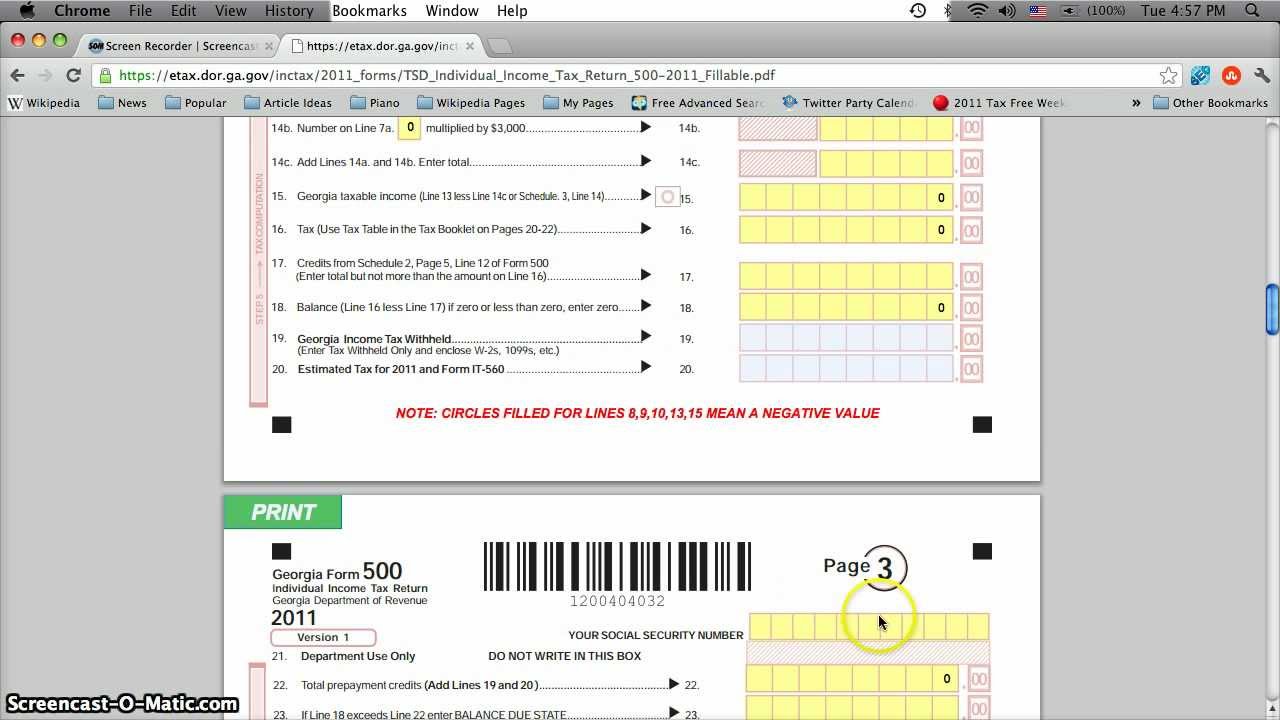

This years individual income tax forms common tax forms income tax forms instructions it 511 booklet income tax form 500. Form dol 800 separation notice for an individual. All internal revenue service irs forms. 2018 georgia printable income tax forms 31 pdfs.

The current tax year is 2018 with tax returns due in april 2019. 500 nol net operating loss adjustment.